In an increasingly competitive private markets climate, 2020 is sure to present investors, lenders, corporate buyers, M&A advisors, and other dealmakers with challenges. In a webinar (full recording found here) hosted by DealCloud yesterday, Private equity International Editor Isobel Markham sat down with Christopher Gaffney of Great Hill Partners, Griffith Norville of Hamilton Lane and Cobalt LP, and Rick Kushel of DealCloud, all of whom are leading dealmakers, fund managers, and technology experts who have unique perspectives on the private equity trends that will impact the market most heavily.

Based in part on data and findings from the Hamilton Lane 2019 Market Overview, the panelists and moderators discussed and contextualized several key metrics to watch as dealmakers prepare for 2020 and beyond. They also detailed the key technology initiatives that best-in-class firms are instituting to ensure value creation and organizational excellence that will impact firms for years to come.

The private markets have never been stronger

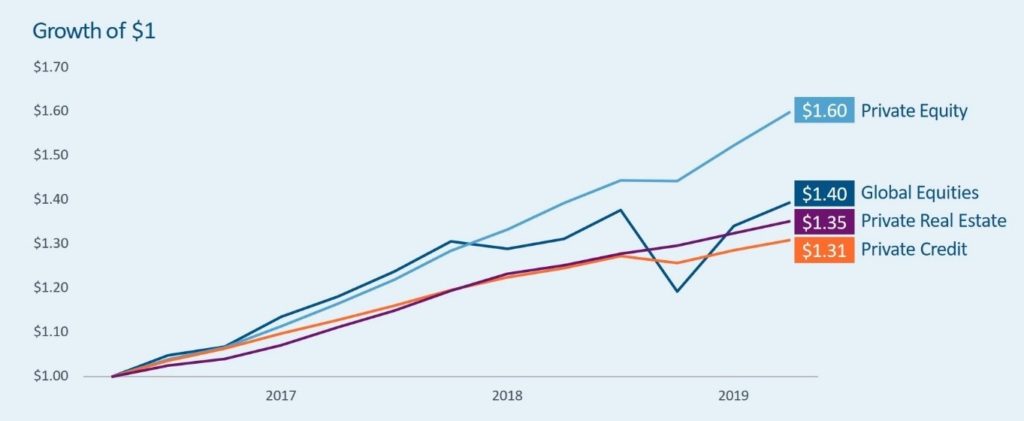

Source: Bloomberg, Hamilton Lane Data via Cobalt (October 2019)

In 20 years, the private markets grew from half a trillion dollars to $5.7 trillion. That is roughly the same as Japan’s GDP. While some investors are bracing for this upward trend of more and more AUM to continue, others think it’s quite normal because the asset class itself is in a healthy growth pattern.

Among the unique strategies GPs are deploying in order to hit these record fundraising numbers include The industry has honed its skills form an operating stand-point. It’s still true that many companies don’t know how to scale their go-to-market activities, and the private equity investors who are operationally-savvy have a lot of room to run.

Looking at the asset class historically, there is a very low risk of loss. Buyouts make up approximately 60-65% of the asset class, and only 14% of buyout funds historically have lost value. These firms are inherently diversified, and it’s very hard to lose money. 71% out-perform the MSCI World Index. So, it’s truly been a very strong decade for this asset class, and it has certainly out-paced that of the public markets (read on for more information about that).

Private company growth is out-pacing public companies

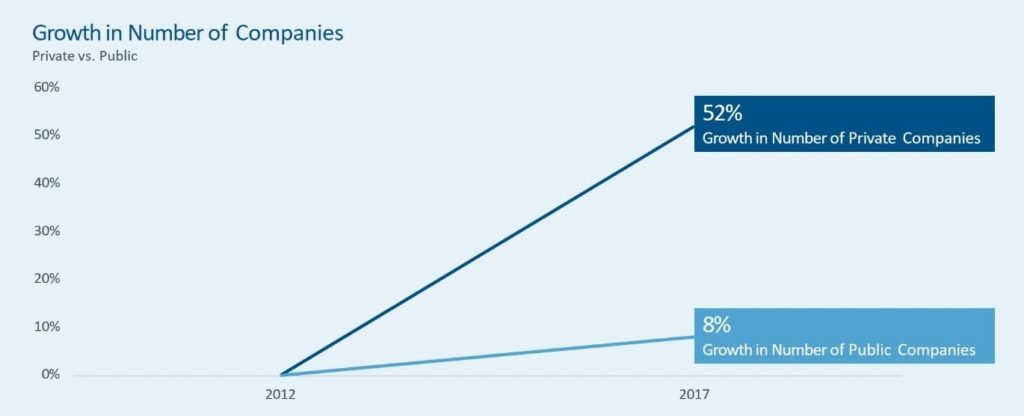

Source: S&P Capital IQ (March 2019)

Since 2012, The growth in the number of private companies has been greater than 50%, while the growth in the number of public companies is only in the single digits. With a huge increase in privately-held companies, participants in the private capital markets are clamoring for new ways to make in-roads with these businesses and their owners.

Many best-in-class firms are investing in the intersection of technology and data – not one or the other. By leveraging the industry’s most trusted third-party private company data sources, including PitchBook, Preqin, and Sutton Place Strategies, firms can layer third-party insights on top of the proprietary data that they own. This is helping them make more confident decisions faster.

Because they’re using technology to do this, they’re also mapping the entire deal ecosystem. Firms who are using data intelligently are also mapping out the accountants, consultants, lawyers, and other advisors that a company is working with or has worked with in the past. Leveraging data in this manner is a necessity for firms now, signaling that 2020 and beyond will feel quite different from decades past, especially if the private equity market trends continue to grow at this pace.

Secondaries and sponsor-to-sponsor deals at an all-time high.

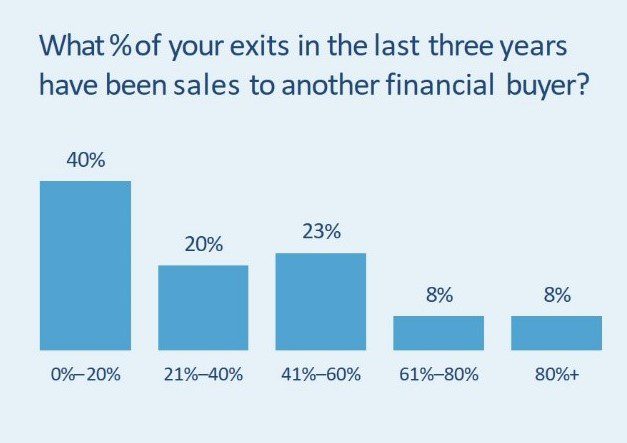

Source: Hamilton Lane General Partner Survey (July 2019)

While some might view GPs view selling to other GPs as “scraping the bottom of the barrel,” others view it as an attractive exit option. The consensus among market participants, however, is that firms need to invest in relationships, data, and technology in order to be successful in the sponsor-to-sponsor and secondaries market.

In the eyes of our panelists, it’s not bottom feeding – it’s natural evolution. Generalist firms are starting to specialize, and specialist firms are now generalists. Some are moving up-market, others are moving down-market. Firms are also trying out new strategies while company owners and boards are seeking out expertise. The collision of all of these factors is making things even more competitive.

The takeaway here is that firms need to institutionalize their knowledge for two reasons: a) to be able to test out new theses, strategies, deal sizes, operating models, etc.; and b) to be able to navigate around the market as these competition-driven experiments are done. Without a technology in place, secondary- and sponsor-to-sponsor deals will continue to “get a bad rap” amongst some.

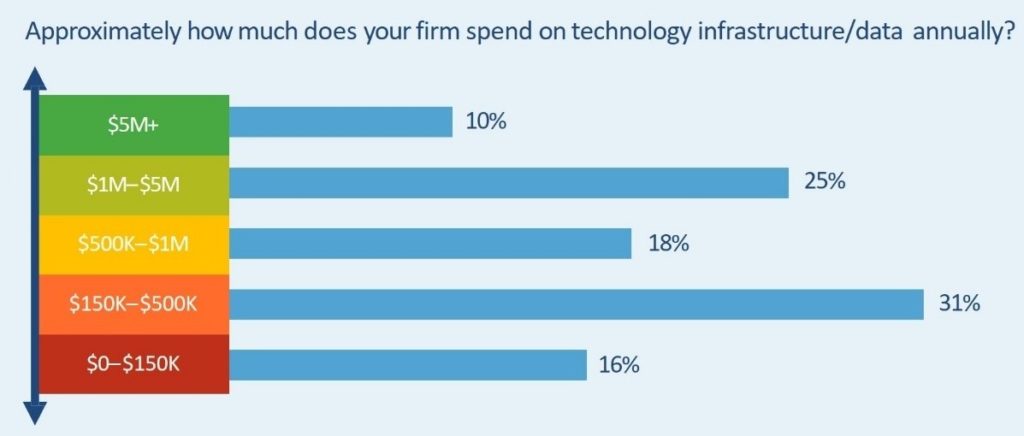

Under-investing in technology infrastructure and data

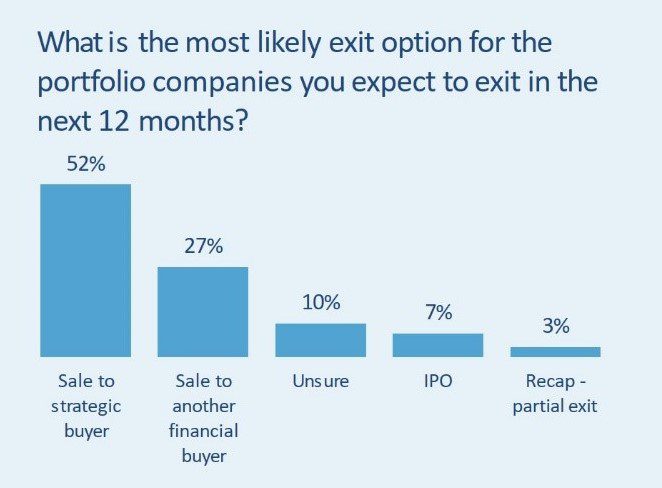

Source: Hamilton Lane General Partner Survey (July 2019)

Over the last three years, both DealCloud and Cobalt LP have spoken with countless firms in the capital markets industry. Most of them did not have a “CRM” or “system of record” installed in-house. That means that many of these firms are using spreadsheets, emails-as-a-filing-cabinet, back-of-napkin notes, memos, and people’s memories to make huge, meaningful investment decisions. Even if LPs aren’t putting the pressure on GPs to make investments in data, technology, and operations, many firms are putting it on themselves because of the associated risks.

What are the risks of not getting your technology house in order in 2020? What are the implications for 2021 and beyond? Put simply, the risk is missing opportunities: you can’t take advantage of what you can’t see. Increased transparency leads to increased opportunities, and sometimes closing a deal is as simple as that.

Click here to listen to the full webinar recording. To learn more about DealCloud, click here.