Keeping an eye on the progress of each deal is a necessity in today’s complex investment landscape and is one of the best ways to avoid a deal falling apart unexpectedly. In this article, we examine ways every member of an investment banking team can leverage technology to increase visibility into any given deal cycle, and how to use that information to steer business development activities firm-wide.

Get information in real time

Gone are the days of “I emailed John Doe and I’m waiting to hear back.” Today’s most effective investment bankers don’t wait until they’re asked to give the latest update about a deal. Instead, the data should tell that story in real-time.

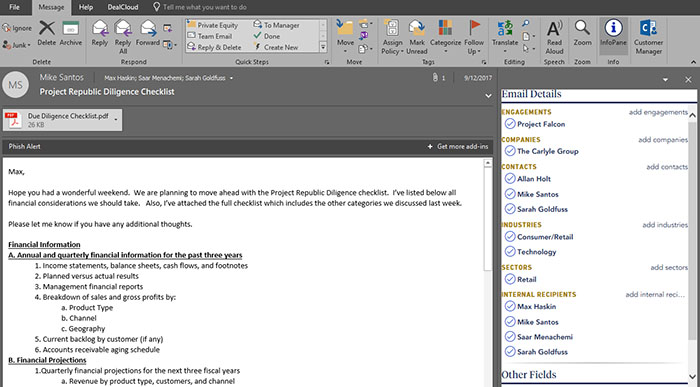

For example, when logging interactions with contacts that team members have via Outlook or Calendar, the details of the conversation and the attachments that are exchanged can be synced to your CRM system with one click. This way, if a manager wants to know the date of last contact without having to ask, it’s all logged in the system. This saves time and energy and helps make more time for other key business development activities.

Let your process speak for itself

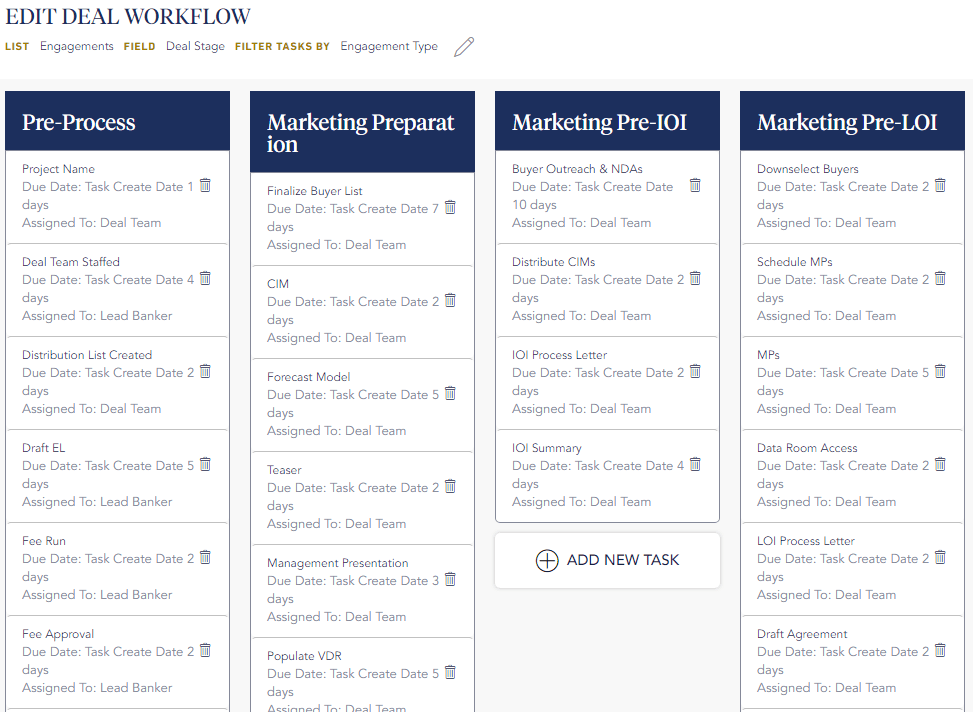

Between the building of a buyer’s list and the legal processes involved in every deal, getting one to close is an intricate, complicated system of steps. For every major “step” in the dealmaking process, there are 10+ mini steps within it. Plus – chances are, every firm has a different spin on what exactly that process should look like.

The specific process that your firm employs should be visible throughout your CRM. In doing so, your team can have insight into exactly where all contacts stand at any given moment, and what next steps need to be taken to move things forward.

Leveraging these customized functions will also help your team add new steps (in the due-diligence stage, for example) or edit others (as the firm changes it’s pre-closing checklist, for example). This flexibility is crucial for keeping the firm nimble and helps ensure the next deal closes more quickly.

Track engagement at every stage

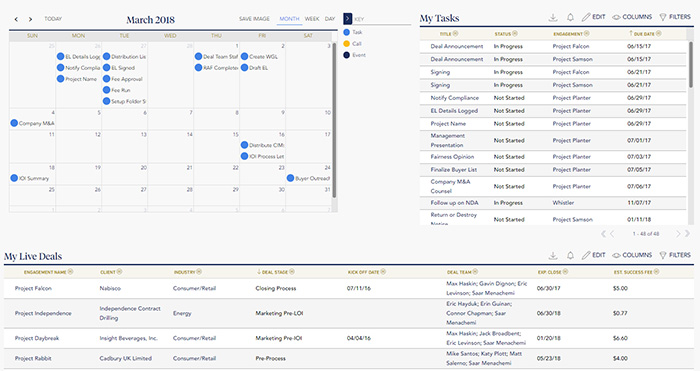

The marketing stage of a deal can be stressful – especially as bankers wait for buyers to react. Keeping a keen eye on these reactions (good or bad) fuels the deal’s likelihood of closing because it shows you exactly how competitive the deal will be, and how valuable the market deems the deal to be.

That’s why it’s so important to have all of this data in one place as the deal progresses. It should no longer be cumbersome to see which interested buyers have access to the data room, and which still need to sign NDAs.

By adding date stamps to each step, bankers can also tell if it’s been too long since the party has been contacted, which may signal disinterest or low purchasing power on the part of the buyer. All of these data points help investment bankers move through deals with more precision, and help them focus their energy on the activities that help a deal get to close.

Encourage ownership

With the technology available today, no team member should ever sit down to their desk and wonder what tasks need to be completed that day. By leveraging a CRM system that mirrors your firm’s unique process, it should be clear which steps an individual needs to take in order to move things forward.

If an associate is assigned to three ongoing deals, for example, he/she should be able to quickly discern which deal requires a discussion with compliance, which needs management meeting material to be completed, and which needs a fairness opinion. This type of transparency into the deal process is helpful for team members at every level – from manager to analyst – and helps ensure deadlines are met.

Conclusion

Achieving deal pipeline velocity requires customization, speed and accuracy: that’s why it simply doesn’t make sense to manage deal processes in Excel.

Having an investment banking technology system that shows you what’s falling behind and what’s in danger of falling off is no longer a thing of the past. Today’s most effective investment banking firms use smart CRM systems to increase visibility into any given deal cycle, to shorten deal cycle times, and to ensure the best outcome for their clients.