At its essence, dealmaking involves finding and executing private capital asset purchases for passive investors or your own acquisitive corporation. Dealmakers transact acquisitions to increase the assets’ worth via a variety of growth strategies, and capitalize on their increased value, income generation, or both to outperform market rivals.

Although this fundamental definition and purpose of dealmaking will likely never change, the ways in which deals are sourced and executed are changing rapidly.

These changes are manifesting in each private capital asset class. Deal origination methods have become asset-niche, requiring specialty tools and processes for VC investors, private equity (PE) houses, CRE sponsors, and strategic acquirers.

Here are some ways you can promote stronger dealmaking in 2023 within your specific asset class.

Venture capital dealmaking in 2023

Dealmaking in venture capital is defined as a financing transaction in which VC investors fund startups in exchange for preferred equity in that company. Although there’s always a risk of the startup failing or performing poorly, it’s a gamble that VCs are willing to take since the potential profit is often much larger than the potential loss.

“Experienced (VC) investors are very much prepared to lose their money,” said Jose Cayasso, Co-CEO of SlideBean. “They are not looking for 1 or 2 return [multiples] on investment; they are looking for that 6,000 [return multiple], unicorn, life-changing win.”

In 2023, VCs will need to be more selective about which targets they pursue, because the chances of “hitting the jackpot” — or, in VC terms, funding or owning a unicorn — have recently plummeted.

PitchBook research shows that for the past 3.5 years, unicorn deals have steadily increased or remained stable. But at the end of 2022, that trend changed.

Until recently, VCs had extra money to deploy, creating a founder-friendly environment. But in 2023, startup valuations have tanked, flipping the bid-ask spread more deeply than in previous corrections.

The 2022 Startup Sentiment Survey, created by VC investor and author Tomasz Tunguz, reveals that startup owners believe the new spread is around 10% — but in reality, it’s actually 44%. “That’s not so much a spread as an abyss,” Tunguz writes about the dramatic change.

The result of the overturn will be an influx of VC firms unable to generate expected returns in 2023. The underperformance will cause them to struggle to raise capital from their limited partners (LPs) beyond their original fund, rendering them “zombie firms.” In fact, industry journalists predict that the number of VC zombies will reach around 50% before things turn around once more.

As a VC team, you’ll be forced to reevaluate how you originate and appraise opportunities:

- Start by updating your investment thesis. Publish your new, clearer ideal criteria to crystalize your goals for external deal sources. This move also sets a no-questions-asked standard to which business development (BD) team members can hold themselves as they sort through inbounds.

- Commit to more data-driven deal sourcing research. Capture and use your own deal origination activity data and combine it with the wealth of startup market information available. To do this, you’ll need a robust, purpose-built information management system that seamlessly integrates with third-party data providers. DealCloud is the only solution that fits this description. As an all-in-one relationship management and deal sourcing and execution workflow platform, DealCloud gives your team unparalleled visibility into the opportunities you’ve performed diligence on before, as well as extensive details about the checks being written in your target markets.

- Budget for more time and an increase in rejected targets. “Deals will likely take more time to complete as VC investors conduct more due diligence and put a laser focus on profitability and business model sustainability,” states the most recent KPMG Venture Pulse report. Prioritize business fundamentals, corporate culture, and profitability over growth and comps, which are no longer relevant in such a VC investor-friendly environment.

Interestingly, many of the ways VC dealmaking is being done this year also impacts the way dealmakers transact in other alternative asset classes.

Private equity dealmaking in 2023

In private equity, dealmaking means the execution of transactions which involve general partners (GPs) who use LP capital and investment banking financing products to buy, hold, improve, and eventually sell (“exit”) business assets. PE deals will always be defined this way, but the tools and processes involved with PE dealmaking continuously evolve — sometimes dramatically, as in the case of hedge fund popularity — in response to economic and market trends.

This year, PE dealmakers are facing falling valuations just like their early-stage investor counterparts. However, unlike VCs, PE groups feel the added pressure of record levels of already-allocated LP capital. Fundraising has not yet followed the downward trends of deal volume and deal values, putting sponsors in an awkward position. Capital allocators want funds deployed, yet sponsors hesitate to acquire while valuations are still in decline.

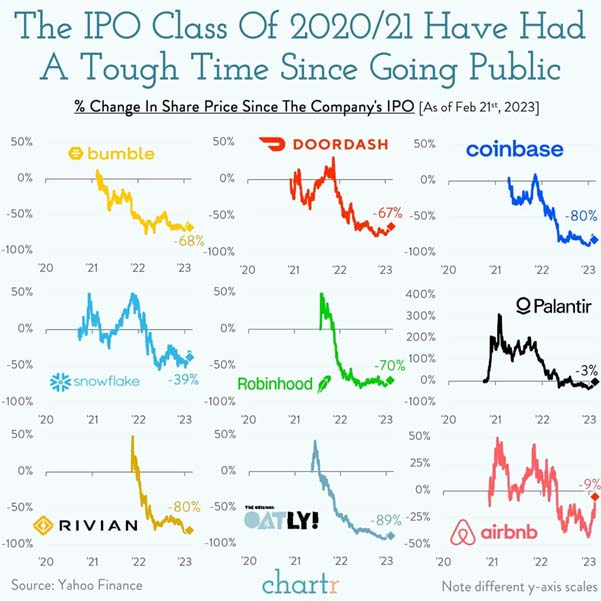

Navigate PE dealmaking in 2023 by adjusting your deal sourcing channels and avenues. Ask your partners, principals, and VPs where they observe or anticipate new bargains. For example, brands that went public in 2020–2021 are scrambling back to PE ownership in record numbers, increasing the opportunities available to buyout firms that have opened their BD teams to those new sources.

If you rely on intermediaries to send private companies your way, encourage them to improve their target screening by adopting technology that can mass-sort and parse startups based on custom criteria.

DealCloud empowers PE houses and investment banks (IBs) by capturing and democratizing internal deal sourcing activities and data so that investment committees can make more confident and accurate decisions faster.

Commercial real estate dealmaking in 2023

Commercial real estate (CRE) deals resemble PE deals so closely that many of the same deal execution and pipeline management processes cross over. However, there are a few subtle differences you should be aware of.

CRE dealmaking is the execution of purchases made by deal sponsors (GPs) who manage an LP-allocated fund by buying, improving, holding, and selling CRE assets. Profits from these real assets come from either commercial rents, improvements or appreciation (“value-add”), or both.

68% of U.S. CRE investment professionals believe we’re already in a recession, according to Morrison Foerster’s 44th Economic/Real Estate Poll. The resulting slowdown will mean fewer hot properties in 2023, according to Greg Reimers, Real Estate Banking Northeast Market Manager for JPMorgan Chase.

“A recession has the potential to reduce demand across all real estate asset classes,” Reimers said, adding that industrial and office space in particular will feel the lull.

Sourcing and closing deals in 2023’s CRE space will require nimble creativity. Tap your current network first, and then introduce yourself to new owners and LPs.

To tap your own network, you’ll need to know who in your firm already knows who in the CRE space, and the context, strength, recency, and potential of those relationships. To avoid endless meetings, you can acquire these insights via robust technology like DealCloud, which provides relationship intelligence. This visual snapshot gives users instant and real-time visibility into their team’s current networking strengths and weaknesses.

If you need a good excuse to reach out and warm up old contacts, check out our creative list of reasons and ways to reconnect with old colleagues in CRE, complete with templated scripts you can leverage.

Once you’ve contacted past associates to ask for referrals, your syndicate will need to exercise outreach muscles that you’ve maybe never used before or have neglected to use for years. For new leads, CRE leaders recommend the old-fashioned cold call and direct mail.

For example, Jesse Fragale, Avison Young’s Vice President of Office Leasing and Investment Sales, recently sourced an off-market (value-add) deal in Toronto’s renowned Forest Hill neighborhood using the battle-tested method of phone outreach.

“That was a cold call to owners who were not particularly interested in selling,” he explained. “Cold calling … absolutely still works.”

David Robinson, Founder and CEO of Canovo Capital, wholeheartedly agrees, stating that direct mail and phone outreach are his silver bullets for sourcing more deals than anyone else in the space.

“Everybody wants to figure out some unique way they’re going to be able to connect with owners before anybody else is going to touch them,” Robinson said. “The reality is there are just a few proven ways to connect with and build relationships with an owner. Direct mail is one of those. So is direct phone.”

With today’s mobile technology, cold calling is much more efficient and effective than the clunky process of yesteryear. DealCloud automatically collects data from your outreach activities to give context to colleagues and get you up to speed the next time you make contact with that person.

Corporate development dealmaking in 2023

M&A dealmaking revolves around the strategic (as opposed to financial) acquisition of corporate assets for the purpose of an enterprise whose business units can produce unique synergies for long-term value creation. These M&A transactions are done by corporate development (corpdev) teams within enterprise organizations.

All private capital markets will face obvious headwinds this year. The good news for corpdev teams is that M&A dealmaking will march on. In fact, we predict this year’s M&A activity will be exceptionally profitable. Two crucial factors will drive 2023’s corporate developments’ acquisitive activities: strategic imperatives and CEO confidence.

- Strategic imperatives — “Cash-rich companies making strategic, bold moves” is the number-one theme in Bain’s list of trends to watch for this year. “Winners don’t pause M&A during downturns,” the report states. “Companies that move quickly when others hesitate are rewarded.” Research proves this statement to be true. Expect this asset class to make most of the industry headlines this year.

- CEO stability and confidence — Stephan Feldgoise, Co-Head of Global Mergers and Acquisitions at Goldman Sachs, notes that most enterprises have learned from the great financial crisis, the COVID-19 pandemic, and ongoing global instability. Leaders have had ample time to strengthen their fundamentals and ready themselves for nearly anything. “We have lived in a world of tremendous volatility and risk for many years,” Feldgoise said. “Boards and companies are looking through the near- and medium-term instability and thinking about the long-term strategic positioning. That’s why you’ll see large strategic transactions continue straight through this period.”

For deal origination, consider emerging sources of corpdev deals. For instance, have your deal origination team watch for take-private acquisition opportunities from brands that went public during the 2020–2021 IPO craze. If you investigate closely, you’ll notice a form of buyers’ remorse developing, exposing what experts called negligent investing at the time.

Another creative way to source better M&A deals is to follow American Express’s example and put origination in the hands of the business unit leaders themselves.

“We spend a fair amount of time with our business partners to really understand their business strategies, what their roadmap looks like, and where there are gaps,” said Lisa Marchese, Head of Corporate Development at American Express. “My group centralizes all of the deal process and management, but that doesn’t mean we centralize all of the sourcing.”

Marchese’s team then creates a cocktail of inbounds. “We get investment bankers, VCs, and private equity firms who will come in and say, ‘Hey, I’ve got an interesting company,’” Marchese explained. “But our business partners are out in the ecosystems, so [our deal sourcing] is a bit of both.” The result is a multi-angle perspective that puts all opportunities into focus against one another in terms of acquisitive synergy and value creation.

Better deal sourcing for dealmakers in every asset class

Recall the CEOs who have used the volatility of the last decade to prepare for future instability. Consider doing the same with your own internal tools and processes. Whether you’re a deal sponsor in VC, PE, CRE, or M&A, your operation needs an information management system that’s as dedicated and competent as your teams are.

To learn more about how DealCloud can equip better deal sourcing in all alternative asset classes in 2023, schedule a demo to tour the product.