As a private equity professional, you need to maintain visibility on every corner of the market in order to successfully compete for deals. Technology is the single most important driver in this feat, giving professionals the ability to move quickly, stay organized, and achieve a sustainable competitive advantage in today’s private capital markets landscape. Over the past few years, having a deal and relationship management technology platform that provides your firm access to private equity analytics has become not just nice-to-have, but an absolute necessity when sourcing (and closing) deals.

In order to stay competitive in today’s modern deal-making landscape, capital markets professionals are orienting their key decision-making activity around a combination of both proprietary and third-party data. That’s why we created DealCloud DataCortex, an integrated private equity data solution that allows dealmakers to manage proprietary and third-party data in one unified platform, empowering them to transform that data into institutional knowledge. Our technology is revolutionizing the way capital markets professionals are using private equity portfolio analytics to their competitive advantage. Because DataCortex is a flexible solution, it can be configured to support your firm’s unique and proprietary approach to data analytics.

Throughout this article, we’ll discuss how to use DataCortex to empower you during all stages of the deal lifecycle, from deal origination to deal execution. We’ll also discuss other ways that modern dealmakers are using data analytics in private equity.

If you are interested in learning more about private equity analytics and how DealCloud’s DataCortex can help you and your firm achieve success, schedule a demo.

A glimpse at DealCloud’s private equity analytics software

Today’s LPs will accept nothing less than a sophisticated and technology-driven approach to investing. That is why the most successful capital markets firms rely on private equity portfolio analytics and other data to inform their decision-making and strategy development. When you work in private equity, growth equity, or at a family office, there is an irrefutable reliance on data reporting and analytics that is growing. By integrating private equity data into our DataCortex solution – including private company details, intermediary information, deals, and more – you are able to search and query data in real-time without ever leaving the DealCloud platform.

Since the DataCortex solution is fully integrated into the DealCloud platform, you can easily run complex reports, analyze industry trends, and evaluate potential synergies in the same hub where you originate deals and manage relationships. Useful, right? Leveraging DataCortex enables your firm to make critical decisions more quickly and identify new, meaningful opportunities that were previously unknown. With the DataCortex integration, you can leverage robust, differentiated private equity analytics to populate your records, reports, dashboards, and tearsheets with high-quality, verified, and in-depth insights.

This revolutionary integration enables a “unified view” that can help your PE firm achieve greater workflow efficiencies, such as populating reports with third-party verified data instead of needlessly copy+pasting data into spreadsheets and Word documents. Our private equity analytics solution also enables firms to streamline due diligence, source deals, and identify new investments.

In summary, our analytics-driven platform and integrations provide PE firms with a sophisticated and technology-driven solution. DealCloud unifies private equity analytics, disparate software systems, resources, and people with fully interactive reporting on your most important metrics, accessible anywhere, at any time. Additionally, since DealCloud was designed with the busy dealmaker in mind, every dashboard, chart, graph, tearsheet, data sheet, and profile can be customized to meet each user’s preferences and interests. Our mobile application is also completely configurable and optimized for on-the-go dealmaking, allowing you to access all the data you need from the palm of your hand.

FAQs

Do I need to migrate all of my data to DealCloud? With the help of DealCloud’s implementation team, your data can be migrated from your existing technology (Excel, Salesforce, etc.) directly into the DealCloud platform. Once your data is cleansed and placed into your purpose-built instance of DealCloud, our product and team will help you maintain good data hygiene in addition to supporting good data governance practices at your firm.

Can I download reports generated by DealCloud? Yes. DealCloud’s private equity analytics solution enables teams to download and design preformatted reports based on any data set from either a web or mobile interface. You can reduce administrative burden by scheduling these reports to be sent to yourself, a team member, or a group of people as a PDF or Word Document at a cadence that works best for you.

DataCortex integrations

DealCloud’s DataCortex solution allows you to search and query third-party private equity data sets directly from within the DealCloud platform. We’ve proudly partnered with some of the best capital markets data providers, and we will continue to integrate with more data sources over time:

| The Factset integration enables firms to populate their DealCloud records, reports, dashboards, and tearsheets alongside verified, proprietary insights from FactSet that are generated by novel data and analysis techniques. |

| DealCloud clients who choose to integrate their PitchBook subscription are provided access to verified public and private capital markets data. When distributed and intelligently connected throughout DealCloud, firms can augment and support existing proprietary data to fuel stronger market coverage. |

| The integration of Preqin’s data and intelligence through DataCortex enables DealCloud users to enhance their private markets knowledge base and super-charge their fundraising and investor relations initiatives. |

| The integration of PrivCo’s industry-leading intelligence into DealCloud’s DataCortex solution allows clients to accelerate research and build business development pipelines more efficiently. |

| Firms leveraging the Sourcescrub integration save time by reducing the burden of manual data entry, get more value from every conference and trade show they attend, and strengthen their acquisition and business development pipelines. | |

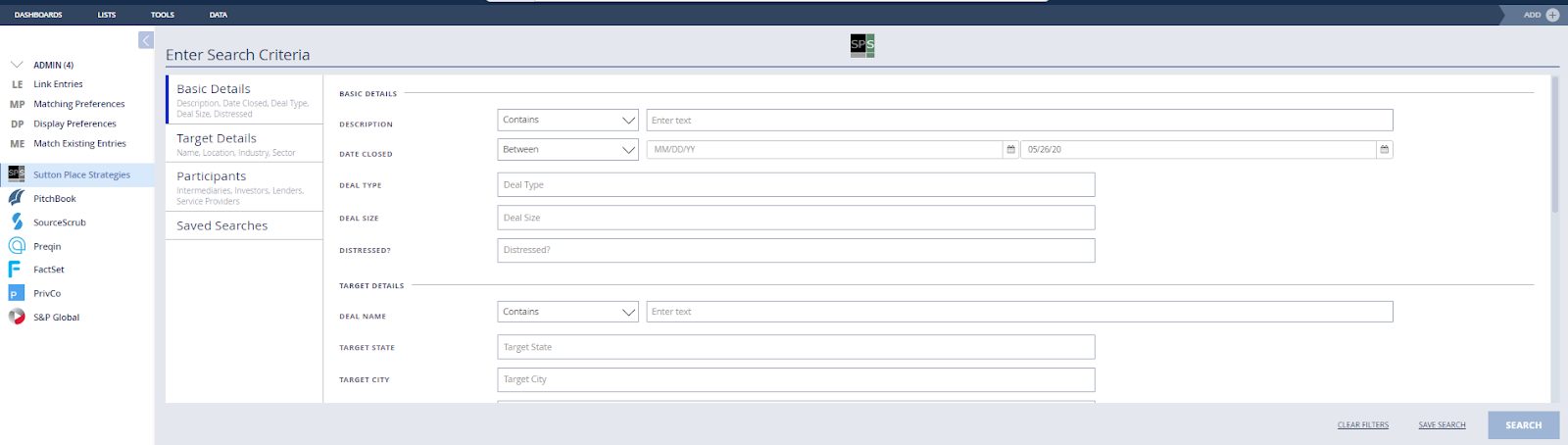

| The integration of Sutton Place Strategies (SPS) data and intelligence through DealCloud DataCortex enables deal professionals to leverage actionable transaction and M&A data in their day-to-day deal sourcing and intermediary coverage initiatives. |

| With the integration of S&P Global Market Intelligence and DealCloud, capital markets firms can leverage S&P Global Market Intelligence’s robust, differentiated data on private and public companies, newsworthy developments, key professionals, industry metrics, and more from within the DealCloud platform through the DataCortex solution. |

Evaluating potential synergies where deals originate

With DealCloud, the days of managing deal activities in Excel spreadsheets and disparate software systems are done. DataCortex coupled with DealCloud’s powerful calculation engine can enrich your private equity firm’s decision-making process and operational efficiency. As a single source of truth for proprietary and third-party information, DealCloud uses private equity analytics to predict outcomes and identify market developments.

In DataCortex, firms are able to search and query data in real-time without ever leaving the DealCloud platform, eliminating the need to toggle back-and-forth between multiple data provider sites. The resulting companies, contacts, and deal information are then matched and combined with your proprietary data – creating a single cohesive record that is displayed based on your preferences. When new data is available or updates are provided to existing entries, these new data points are automatically updated, which significantly reduces the need for manual input and helps avoid duplicate entries.

Using DataCortex, you can search for information and data about a particular transaction target or firm and uncover the deals your firm has never seen or have never been presented.

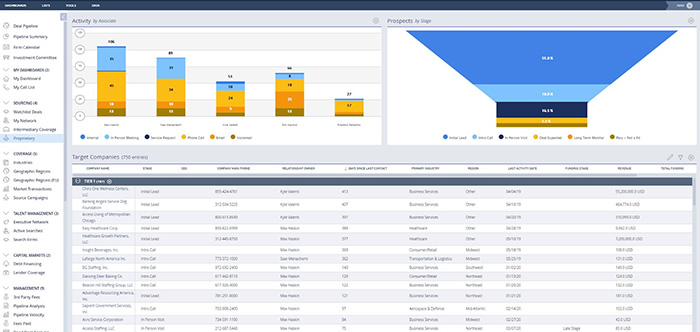

DataCortex is also a key tool you can leverage when sourcing new deals. Using the below Watchlist Deals dashboard in DealCloud, you can keep track of deals by fund, stage, transaction type, and more.

When sourcing new deals, keeping track of your network is of the utmost importance. Using the below “My Network” dashboard, you can view which of your contacts you need to reach out to, their activity, deals, and network contacts by industry type.

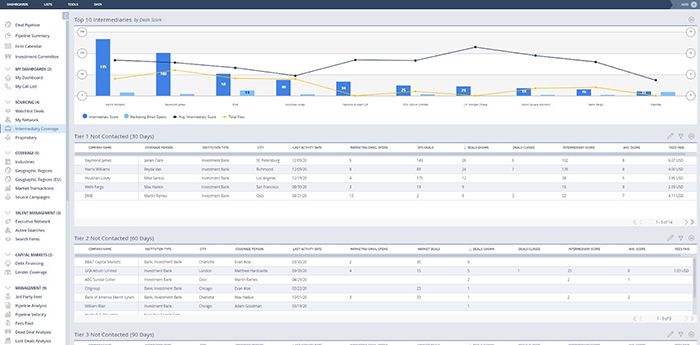

Using the below Intermediary Coverage dashboard in DealCloud, you can view your intermediaries by deals score and tier, in addition to being able to view your contacts and their activity.

DealCloud also allows you to view your touchpoints with your contacts whether it be in-person, through a phone call, email, or another form of communication.

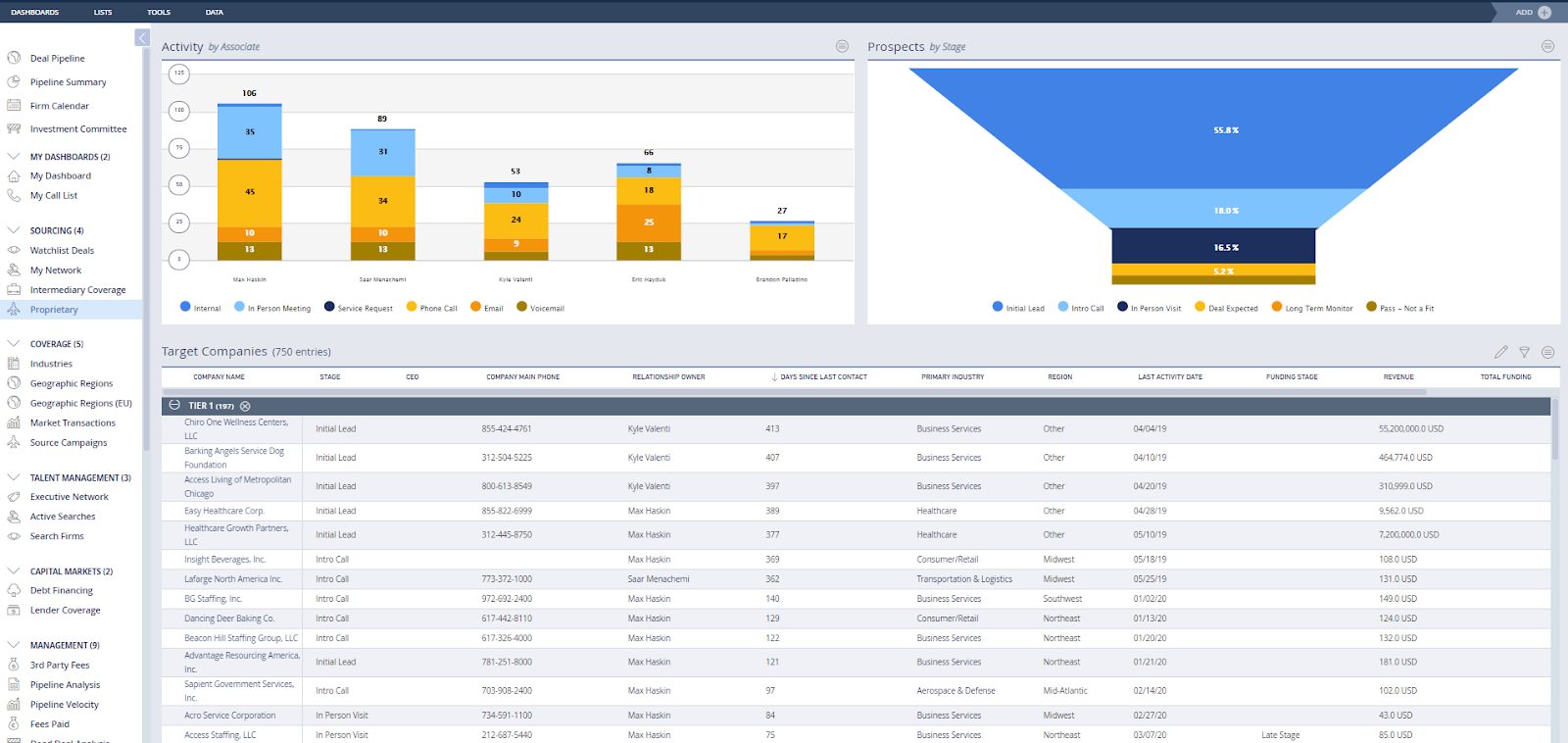

With the Proprietary dashboard, you can view all activity, prospects by stage, target companies by stage, and more.

We understand that private equity professionals handle many tasks at once, so we configured the DataCortex solution to be accessible from anywhere and can flex to meet the unique setup and needs of your team.

- Accessible from desktop and mobile (iOs and Android)

- Allows for custom workflows

- Set permissions at the individual or team level

- Map third-party fields to your proprietary taxonomy

- All data flows to automated/downloadable reports

- Automatic data refresh

No matter what part of the investment lifecycle you focus on, DataCortex harmonizes every data set that the firm owns or outsources. This provides better company, advisor, sponsor, and LP coverage; more efficient deal execution; and increased industry coverage.

Explore all DealCloud features

Start sourcing deals through data

Investors who have chosen DealCloud’s private equity analytics software, finding DealCloud to be the “right” solution for their firm, have been able to run laps around firms with industry-agnostic tools in the same way they’ve out-performed firms that have no technology at all. The platform, along with our DataCortex solution, has enabled them to act more quickly and confidently through modern data verification methods, data visualization strategies, and expert reporting and analysis. Using the DataCortex solution is a way to both save time and fuel efficiency when discovering new deals. To learn more about DataCortex and to revolutionize the way you’re using private equity portfolio analytics tools, schedule a demo.