To keep up with clients’ growing demands and expectations, an increasing number of private equity (PE) firms rely on customized tools and tech-enabled deal flows to enhance service delivery. A recent Deloitte study reported that 39% of PE firm representatives believe AI, process automation, and other advanced technology has improved their operating margins — an encouraging statistic for any firm still considering whether to invest in these tools. Unfortunately, many firm leaders remain unsure of the best ways to select and implement new technology, and risk falling behind their competitors as a result.

Chase Paxton, Director of Finance and Valuations at NGP Energy Capital Management, and Rob Kaufman, Vice President of Investor Relations at FTV Capital, recently shared key information about how sector leaders are tailoring their data ecosystems to their unique needs. Learn how your firm can leverage point products and DealCloud technology to gather crucial data and connect with your clients.

Upgrade Third-Party Data Services for Dealmaker and Player Intelligence

Future-forward firms see data acquisition as a first-mover advantage. Both Paxton and Kaufman are investing in the best real-time private company data from reliable, compliant, and creative sources. As you explore your options, choose a market intelligence tool like PitchBook or SourceScrub that securely and seamlessly connects to your private equity–specific customer relationship management (CRM) platform.

Suggested Tool: SourceScrub

The data service SourceScrub provides reliable sell-side intelligence. It combines web-crawling automation with human verification to provide real-time data — including private company ownership, growth intent, funding, and size. Buy-side users can filter the data to narrow down to the most relevant results.

Dealmakers can leverage DealCloud’s SourceScrub integration while using DealCloud to help track conversations directly within the platform.

Suggested Tool: PitchBook

PitchBook provides market intelligence on recent and current deals, and compiles venture capital (VC), PE, and merger and acquisition (M&A) activity from more than 3 million companies. This information is especially valuable considering the recent growth in deal activity: A recent PwC report revealed that 21.9% more deals closed in the first 5 months of 2021 compared to the same period in 2020. PitchBook gives you a clear view of where that untapped potential could go next; dealmakers can leverage PitchBook data from within the DealCloud platform.

Gain Better Data Visualization and Reporting

Using a digital investor portal, competitive firms hand power back to limited partners (LPs) and other stakeholders to answer their own questions and minimize back-and-forth correspondence.

Suggested Tool: FIS Data Exchange

Paxton’s team uses the digital investor portal FIS Digital Data Exchange, also known as FISDX. This tool enhances the general partner (GP) and LP relationship by giving LPs access to many of the same business intelligence tools GPs are using to visualize data. For example, FISDX automatically updates basic investment information to answer common, urgent questions that would otherwise take time away from GPs and their teams. Once GPs and LPs connect, they can share key insights needed to make the best possible decisions.

FIS Digital Data Exchange securely and seamlessly connects to your PE-specific CRM — a huge factor to consider when building your data ecosystem.

Harness Next-Level Portfolio Monitoring Solutions

Instead of outsourcing portfolio monitoring, today’s competitive fund management firms are using business intelligence tools to manage their portfolios.

Suggested Tool: Cobalt

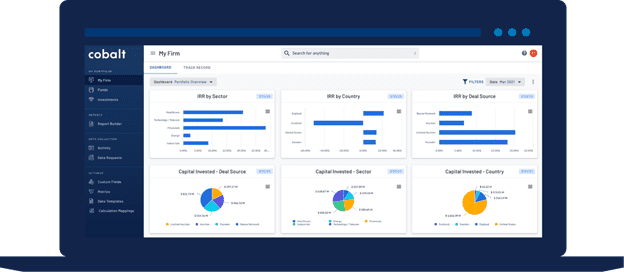

Kaufman’s team uses the portfolio monitoring platform Cobalt. The tool lets investor relations (IR) teams, managers, deal-team members, and partners design their own personalized data consoles. The moment dealmakers log in, they only see role-relevant portfolio company performance.

One of the most powerful features for PE firms is Cobalt’s scenario modeling and public market equivalent (PME) benchmarking. Together, these capabilities give dealmakers a clear view of the market’s landscape as well as potential routes to navigate their often-complex environments.

Using Cobalt, firms can create an airtight audit trail including source documents, running collaborative comments, and other supporting files. Cobalt also maintains a database that’s always ready for audit requests and due diligence. Most importantly, Cobalt empowers firms to track their internal rate of return (IRR) by sector, geography, and source, resulting in a more obvious, dependable way to generate future value creation plans.

Source: Cobalt

Suggested Tool: iLEVEL

Investor reporting requests have been a perennial challenge, and today’s investors want more-frequent updates than ever before. In 2021, IHS Markit reported that 63% of fund managers saw an increase in the depth and breadth of these requests, straining GPs’ time and resources.

To answer this demand, Paxton’s team uses the portfolio monitoring tool iLEVEL, which automates the collection of ever-changing data on portfolio companies’ health. With this automation, GPs can extend beyond basic reporting, analyzing data to share reliable takeaways, trends, and conclusions to collaborate in real time with LPs. This visibility helps set GPs apart and reassures both partners and regulators. Like Cobalt, iLEVEL can connect securely and seamlessly to your PE-specific CRM.

Select Sector-Specific Accounting Tools

A variety of new accounting tools address the private equity sector’s niche financial reporting and analysis needs.

Suggested Tool: FIS Investran

Investran, also known as FIS Private capital Suite, provides accounting software for fund managers that manage third-party funds in addition to their own capital. Like other accounting tools, Investran automates calculations and complex functions, but GPs can also use this tool to handle complex fund structures, support multiple sets of books, and enable unique distribution timeframes and methods — tasks that QuickBooks and FreshBooks simply can’t address.

Communicate Like Niche Publishers

Regularly communicating with clients is key in building and maintaining good relationships. Technology and outreach tools not only help you connect with your network but also provide invaluable data around your connections.

Suggested Tool: Mailchimp

Firms typically don’t need enterprise marketing software to attract customers. Instead of targeting the masses, dealmakers need to reach a small number of high-caliber customers with the right message at the right time. An email marketing tool like Mailchimp lets eliminates the need to hire a dedicated email marketing team. Mailchimp provides basic but customizable capabilities, and it’s easy to use. Best of all, Mailchimp provides a helpful snapshot of basic engagement metrics so you can see how your audience interacts with your emails.

Suggested Tool: Dispatch

DealCloud’s own communication technology, Dispatch, pulls a PE firm’s business development and marketing efforts into a unified platform, so you never need to switch to a third-party tool. Dispatch provides landing pages, custom web forms, and engagement analytics, and lets you communicate with your audience through a medium that’s native to your PE CRM — unlike other tools that require API configuration.

Suggested Tool: Cvent

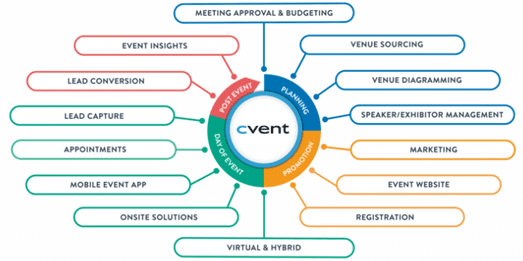

Cvent lets teams meet both in person and virtually for high-impact person-to-person encounters. For virtual events, Cvent publishes a native event app tailored to your occasion, and provides a website that handles registration and video streaming, and lets you host a virtual trade show. For in-person events, Cvent provides a 360-degree experience, positioning your PE firm as the ultimate host.

Get More Benefits from Data Rooms

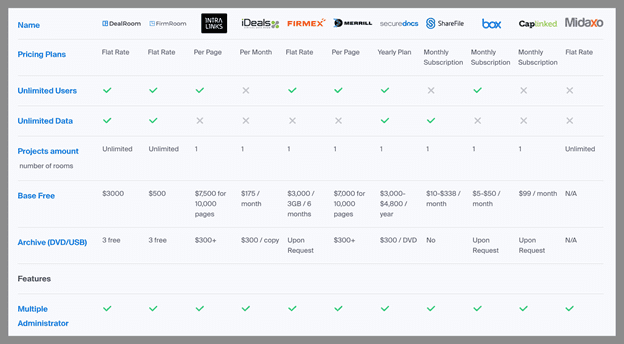

Modern PE firms use virtual data rooms (VDRs) to conduct due diligence, structure deals, and implement strategies. DealRoom offers side-by-side comparisons to help you choose which VDR is best for you.

Source: DealRoom

Suggested Tool: SmartRoom

Kaufman’s team uses the VDR SmartRoom to send capital calls, distributions, quarterly reports, and K-1s. The team’s customized space holds everything LPs need to assess funds and make investment recommendations. The self-service portal, which includes a native DealCloud integration, lets LPs securely access confidential data without the need for time-consuming phone calls or emails.

Looking for another SmartRoom success story? Learn how Heritage Group uses SmartRoom to make their workflows less complex and more harmonious.

Suggested Tool: Box

Paxton’s team prefers Box to host data rooms that include due diligence, bidding, negotiations, and other deal content. Box lets firms create, store, and collaborate on multiple types of files, allowing interdepartmental groups to produce videos, manage product specifications and marketing materials, and view recorded meetings — all in one place.

Consolidate Point Solutions to Create a Single System

Many sector leaders are putting distinct teams onto a CRM platform and using point products like those mentioned above; however, investing in DealCloud gives those leaders an even greater advantage. Teams can map all point-product data back into the single DealCloud platform, where they can easily view a single source of truth, generate insights, and find the most profitable relationships and deals. By integrating your point products with DealCloud, you’ll be one step ahead of the game and better enabled to connect with your clients.

Schedule a demo to learn more about DealCloud.