At least 50% of mergers and acquisitions (M&A) deals fail — and one of the main reasons is that dealmakers aren’t properly equipped to support each unique stage of an M&A transaction.

The good news? You can beat those dismal odds by understanding the deal stages of a typical M&A transaction and investing in the tools your deal team needs to execute each stage. Read this high-level flyover of M&A transaction deal stages to learn how new and seasoned dealmakers alike can best navigate the transaction process.

Stage 1: Originating viable deals

Deal origination refers to the ongoing sourcing of new M&A targets. The more quality deals your business development team sources, the less time you waste wading into resource-intensive deals that never bear fruit. To be more efficient, acquisitive, and profitable, focus on the most viable deals from this origination phase.

Screen your target for a strategic and investment thesis fit

Start originating more viable deals by analyzing them against your investment thesis. This initial screening tempers what McKinsey analysts call “deal fever,” or the debilitating tendency to overlook negatives in favor of “hot” opportunities outside your team’s desired sphere of influence.

To screen potential purchases, have team members collect thesis-aligned opportunities — and preliminary cases in favor of them — and present them in strategic planning meetings. Focus on the target’s key assets rather than definitive numbers or financials, and mull the brand’s reputation, talent, technology, competitive advantages, and/or demand-fitting products. Your senior management and board can then approve and rank the candidates in order of potential perceived value and urgency.

Although finding deals is surprisingly easy, keeping them organized as they progress can be difficult, especially if you don’t have a firmwide information system. A purpose-built M&A deal management system, like DealCloud, can help your firm compile, organize, and generate insights for all new, ongoing, and old targets. DealCloud also integrates seamlessly with SourceScrub, the industry’s most reliable channel for relevant, real-time private company marketplace data, so you can stay up to date.

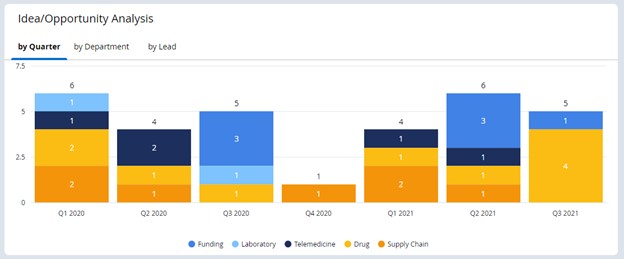

With DealCloud, M&A professionals can sort opportunity values by custom identifiers such as quarter and industry.

Value the target preliminarily

After screening a target, you and your team will need to initially value the company and generate figures concerning:

- The validity of a private company’s cash flow modeling estimates within the market and against similar purchases

- Alignment between your initial price and the seller’s expectations, even within a ballpark range

- The company’s history and likely future performance (e.g., when a startup’s lack of track record could warrant a price discount if your analysts can’t base projections on past performance)

To value a private company that doesn’t have publicly traded ventures or disclosures of targets further down the pipeline, estimate the business’s EBITDA (earnings before interest, taxes, depreciation, and amortization) multiples.

Stage 2: Building relationships

Relationship building is an ongoing effort that all firms must prioritize. Relationships keep your deal pipeline full by introducing new contacts, moving warm targets through current deal stages, and inviting old contacts to collaborate again. In a typical M&A transaction, dealmakers nurture existing relationships and spark new ones by reaching out to the acquisition target’s founder or representative.

Contact founders or current owners strategically

Your corporate development professionals should approach the seller of a private company thoughtfully. The more prepared and professional your overtures, the more you’ll honor both the selling agents and internal stakeholders. People like line managers, your field team, investor and public relations teams, treasury professionals, legal teams, and corporate senior management will appreciate the upfront legwork.

Before reaching out, review publicly available information about the target and its leaders’ past moves. Draft up a communication angle that shows your sincerity, professionalism, and strategic rationale. Include what your analysts estimate the target’s sales and operating assets may be.

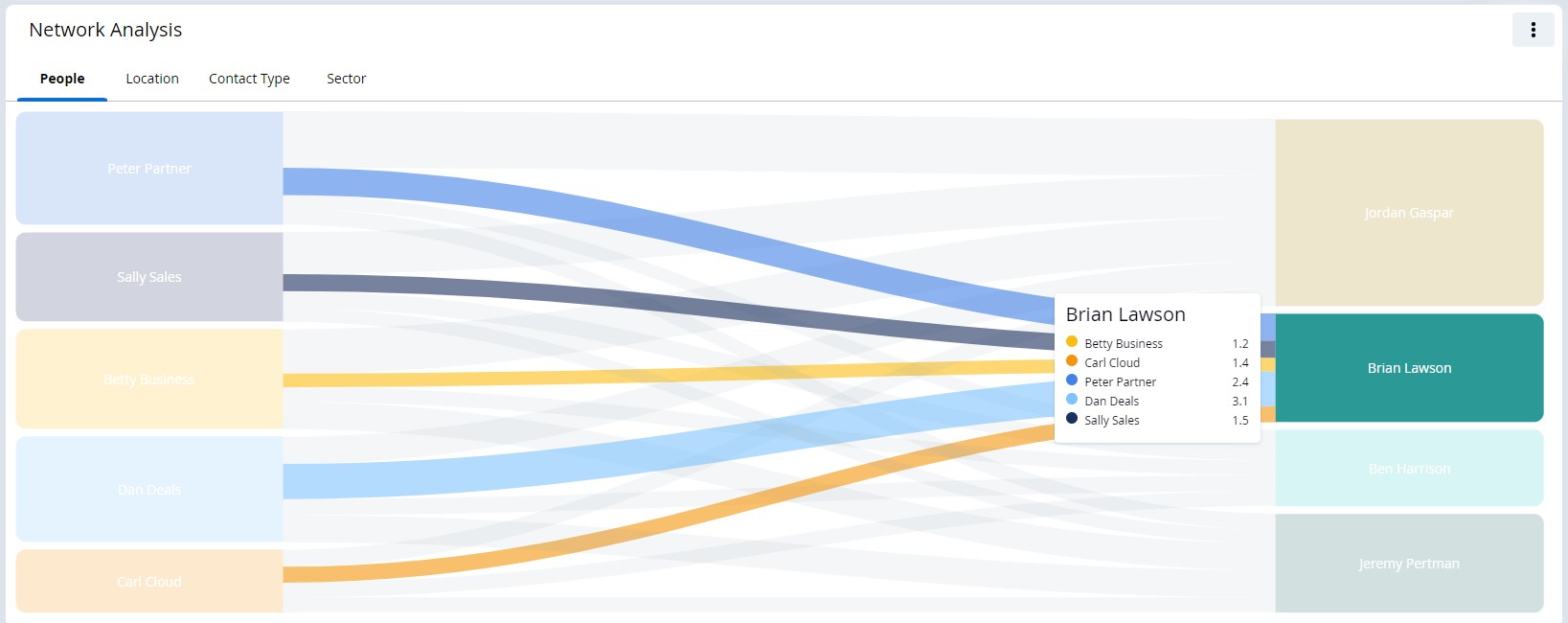

Investing in technology like DealCloud can streamline this work and provide unparalleled M&A relationship management capabilities. For example, DealCloud uses an algorithm to calculate broker relationship scores, factoring in the recency, volume, and types of engagements you and the broker have been involved with. Once you view that score and determine the strength of your relationship, you’ll have a better idea of when and how to contact that broker.

DealCloud’s Relationship Intelligence solution allows users to see network connections and relationship scoring at a glance.

Share confidentiality agreements

As you build relationships with acquisition targets, expect to receive both teasers and drafts of the sellers’ nondisclosure agreements (NDAs). Teasers are typically distilled information memos — one-pagers put together by agents to whet the appetite of buyers without sharing a target’s identity. NDAs are contracts that define confidential information, coverage of the buyer’s advisors, and/or non-solicitation provisions.

Although the purpose of these forms is to ensure the privacy of sensitive information, they can also help your firm assess whether a target is a strategic fit for your investment goals. Scrutinize the terms of these agreements and ensure you’re comfortable agreeing to the parameters they detail.

SmartRoom, an M&A-specific tool that serves as a secure virtual data room, can help firms with this deal stage. With SmartRoom, highly sensitive documents of M&A transactions can be exchanged, stored, and accessed with customized permissions.

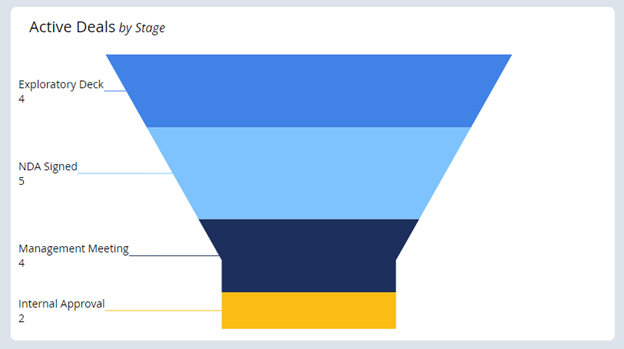

Organize your pipeline by stage and manage deals more effectively pre- and post-NDA.

Stage 3: Conducting due diligence

Due diligence is unquestionably the most resource-intensive M&A deal phase. As your acquisition team gathers and generates information, you’ll need to refine and validate the valuation hypotheses you created when first originating viable deals.

Most dealmakers consider due diligence the most important M&A deal stage because the information gathered allows them to transact with confidence. Without this transparency, firms are forced to make ill-informed decisions that lead to inflated valuations and less-than-stellar strategic returns.

Prepare for due diligence

Some deals fail because deal teams jump into inquiries, investigations, and disclosures without a plan. Avoid this trap by strategizing due diligence up front and assessing your current talent allocation.

DealCloud’s customizable and flexible deal stage view shows decision-makers what phase each dealmaker is working on so they can assign those with more bandwidth to a new deal’s due diligence work. Assign a leader to assemble a due diligence team and have that leader plan upcoming team briefings with the lead transaction lawyer.

Additionally, your firm can utilize a firmwide calendar so that decision-makers aren’t the only ones aware of due diligence meetings and where teams are concentrating their efforts.

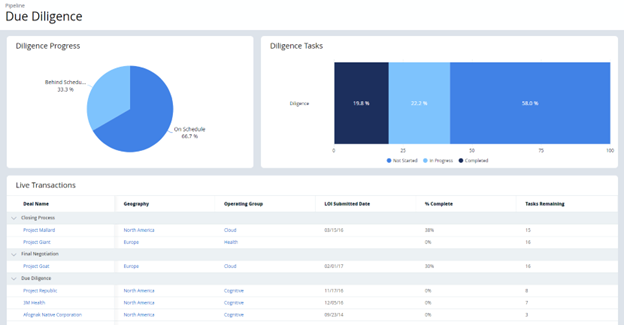

With DealCloud, firms can build dedicated dashboards for due diligence where they can easily view the status of every deal in their pipelines.

Assess corporate matters, management, and operations

The first formal phase of due diligence goes beyond public records and consultant research. Sellers’ accountants and lawyers must provide customized due diligence checklists to inform firms of the target’s current business structure and operational outlook.

Combine the checklists provided by the seller’s agent with your own to investigate:

- Articles of incorporation and the seller’s bylaws

- Corporate committee meeting minutes, including shareholder resolutions and stock transfer records

- All shareholder agreements, including stock owned by the company, restrictions on stock transfers or mergers, and purchase rights for preferential stock or other assets

- Third-party and governmental approval or authorization to sell or merge

- Management reports that show operational performance against regular planning and key performance indicators (KPIs)

- Current functional personnel policies and standard operating procedures (SOPs)

Investigate financial, tax, and insurance matters

Another area to explore during due diligence is the target’s finances and insurance coverage. The more you know about these matters, the firmer and more refined you can make your valuation. You’ll need to gather:

- Audited financial reports — or at least balance sheets and income statements — for the past 3 years

- An analysis of monthly inventory for the past 3 years, including information about currently aging or obsolete inventory

- A receivables analysis

- Management reports that show if and how actuals have deviated from financial budget plans

- An explanation for any changes in accounting methods or principles in the past 5 years

- Statutory filings wherever the target must file taxes

- Bank accounts and credit agreements

- All insurance policies that the target holds, including liability, workers’ compensation, property, and casualty coverage

- A history of all insurance claims and losses

Third-party tax, accounting, and even legal consultants are often able to obtain these records without leaking news or creating rumors about the deal.

Evaluate legal matters and human resource practices

Learn everything you can about your target’s legal and employee matters to further understand the target’s value and strategic fit. Access information such as:

- Pending and settled corporate litigation from the past 5 years

- Civil or criminal charges brought against any officer or member of the board, including dropped, settled, and pending charges

- Closing documents from company stock or material asset sales

- Closing documents from the company’s purchase of other businesses or business interests

- All documented policies regarding hiring, compensation, promotions, and employee departures

- Labor contracts and synopses of any labor disputes

- All individual employment agreements, including executive compensation, bonuses, and profit-sharing agreements

Explore market research, sales, and marketing information

The business’s position in the marketplace can tell your team a great deal about its value. Your team should investigate:

- Market research reports, including competitive analyses and positioning history with outcomes

- Sales history — in both units and dollars — for the target’s services or products from the past 5 years, as well as any events that influenced any spikes and dips

- Marketing spend by type from the past 3 years

- All promotional agreements that the seller proposes the buyer will assume

- Marketing calendar for the foreseeable future, including campaigns and budget

- New products introduced in the past 3 years and any planned new offerings

- Discontinued products, and whether and how research and development failed these offerings

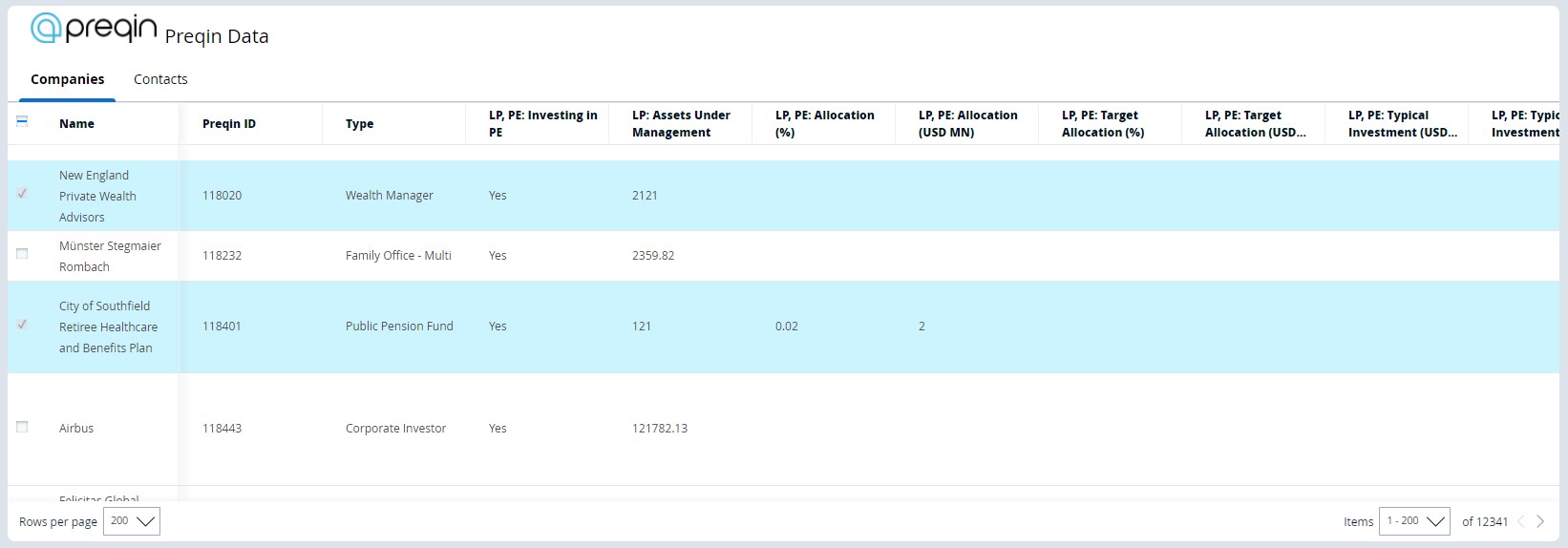

For this M&A due diligence deal stage, consider using a tool like Preqin, which offers unparalleled private company intelligence.

DealCloud offers integrations for third-party data providers such as Preqin so that users can access market data directly within their pipeline management systems.

Mitigate risk and check for compliance

As an M&A dealmaker, you don’t want to learn about all the liabilities you’ve acquired after the transaction is complete. Instead, take the following steps early on in your strategy:

- Obtain the business’s manufacturing safety checklists

- Review all quality control procedures

- Investigate existing emergency response plans

- Determine any outsourced manufacturing, maintenance, and inspection practices, and obtain proof of those agreements

- Get a list of the target’s top 20 vendors and suppliers, and scrutinize their agreements for supply chain risks and incoming material inspection

- Read material safety data reports for any materials used or produced on-site

- Review all Occupational Safety and Health Administration (OSHA) inquiries from the past 5 years of operation

- Analyze technology for security opportunities and differentiators as well as challenges such as redundancies, integrity gaps, and point products

- Contract a certified environmental consultant to conduct an Environmental Site Assessment (ESA)

- Most importantly, adopt a conflicts management software that allows you to manage all of the above within your deal flow and mitigate risk successfully

With a dedicated risk analytics dashboard, firms can transparently assess potential concerns for compliance issues.

Stage 4: Closing the deal

Many M&A transactions have made it to the closing stage only to falter or fail. If an acquisition breaks down at this point, the time and resources spent to get this far are lost. Now is not the time to relax; instead, deal teams must pay close attention to every detail to get a transaction across the finish line.

In the closing stage of an M&A deal, the firm’s counsel typically organizes the process. Usually, the counsel finalizes the purchase agreement and double-checks that the deal has all the necessary approvals. The legal team handles the paperwork, including drafting closing documents, compiling and flagging signature pages, and delivering the packets to the proper parties.

Account for accounting

As you learn everything you can about the target’s finances, you must also pay attention to your own firm’s finances. When two businesses merge, the buyer must navigate the accounting process carefully; otherwise, fees, fines, and losses could threaten the deal’s benefits.

Start by negotiating and deciding how much networking capital must be available at closing. Give yourself a cushion of extra working cash to integrate accounting methods.

Next, compare your accounting principles with those of the acquisition target. For example, if your firm uses IFRS as applied by IASB, and if your new acquisition uses the U.S. generally accepted accounting principles (GAAP), you’ll want to hire extra accounting help to merge the two departments’ practices as soon as possible.

Together with the seller, calculate triggering financial indicators like future EBITDA to estimate and schedule upcoming payments from earnout clauses. This way, neither party is surprised when those events take place.

Plan for integration

Failing to integrate means the deal is a failure, even after all the closing documents have been signed. Thankfully, many professionals have documented how to successfully integrate. Learn why integrations fail and study past failures. Combine that with your team’s observations and creativity, and you’ll have a value-creating engine.

You can then choose to either become an expert in M&A integration or outsource the integration work to another firm. We recommend a mix of the two: Rely on experts for the first few deals, but take copious notes along the way so that you can become a self-sufficient M&A integration leader in your niche.

Knowing deal stages is key to deal velocity

No stage of an M&A transaction is easy. Each phase requires intelligence, thoroughness, and perseverance. And even with those strengths, any number of mid-stage surprises can derail a deal.

Once you understand how an acquisition typically progresses, you can simplify and streamline your collective work. This way, when an unexpected wrench is thrown in the gears, your dealmaking engine can continue humming along.

A well-organized firmwide dashboard empowers M&A professionals to remain synced on deal flow at all times.

By leveraging deal management and relationship intelligence systems, you can easily streamline your work at every stage of a deal. For more on how technology can empower every step of your M&A deals, contact DealCloud to speak with an expert today.