According to the most recent 2020 SEI/Preqin Future of Real Estate Survey, the commercial real estate (CRE) industry has been one of the last industries to fully embrace technology, despite the many benefits real estate investor software provides. Modern, industry-specific platforms can collect and analyze data at record speeds, and would allow CRE investors to make investment decisions with real-time data.

Rather than remain at a competitive disadvantage, CRE investors should adopt real estate investor software like Intapp DealCloud that will help them harness the cumulative intellectual capital of their people and processes. With DealCloud’s cloud-based platform, real estate investors can easily manage relationships, execute deals, and seamlessly connect with external solutions and third-party data providers — all within a single source of truth.

1. Inform deal flow management

Without CRE investor software, acquirers must scour multiple sources each day to find new opportunities to fill their deal pipeline and determine changes in their strike zone. To add to the inefficiency, their teammates are likely to check the same resources and obtain the same information, creating redundancies that slow buyers even further.

“It isn’t as easy as pulling up a website that shows all the best properties for sale,” writes CRE investor Brent Sprenkle. “Unlike single-family homes, there is no particular place on the internet where every commercial property is advertised for sale.”

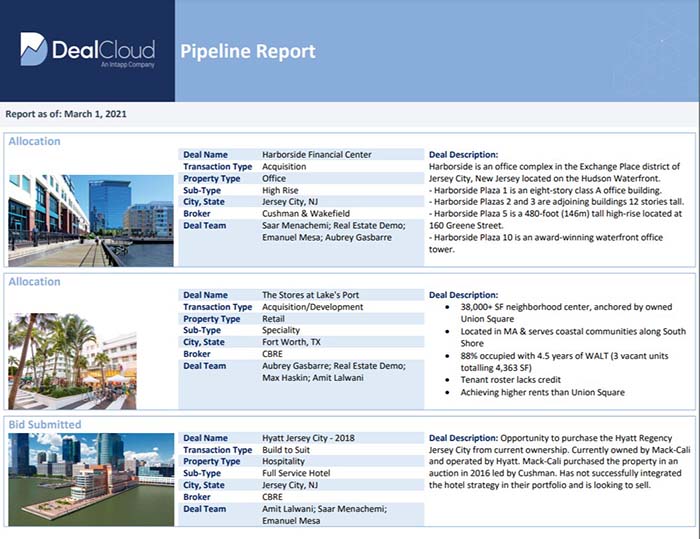

DealCloud, however, gives firms a 360-degree view of deal flow pipelines to prevent duplicate efforts and help identify opportunities. The software also offers active deal summary reports, which conveniently show CRE dealmakers where opportunities are in each stage and region.

Paola Yawney, Director of Business Development at Balfour Pacific Capital, said in a recent panel discussion that DealCloud has directly impacted her team’s ability to source deals: “[The COVID-19 pandemic has] made traveling more difficult, but by having [DealCloud] technology … we’re able to minimize the travel.”

Yawney also explained how her team leverages DealCloud’s reports to get more mileage out of every business trip. “We have to see our portfolio assets,” she explained, referring to potential property investments. “So [as we’re traveling], we take advantage and see other assets in the area … We can leverage the technology [to determine] which assets are there and which markets are very favorable, or very attractive, to us.”

DealCloud helped Balfour Pacific’s deal sourcing team rebound from the pandemic’s initial blow. In 2020, the group closed 120 successful transactions; in 2021, it closed more than 200.

In addition to sourcing deals, dealmakers can use DealCloud’s deal pipeline dashboard (below) to view their deal funnel across the firm in real time, as well as track, report, and gather insights on their real estate pipelines in ways never before possible.

With a single click, users can rearrange and view the same deal information through the lens of their related properties or relationships.

2. Optimize relationships

To ensure that their networks remain strong, CRE investors must check in regularly with their contacts, including brokers, property owners, and even active participants in neighborhood discussion forums. Without a CRE-specific, purpose-built tool, information about these connections can quickly become disorganized, jeopardizing your relationships.

By investing in real estate investor software that seamlessly integrates into your existing CRM system, you can leverage the power of both tools to promote professional connections. CRE investor software like DealCloud gives users a holistic view of all their firm’s industry relationships in real time, allowing teams to build upon their touchpoints instead of constantly wondering where to route resources.

Additionally, DealCloud lets users configure the software to send notifications whenever other users input data. This can help investors stay updated on deals, relationships, and other crucial information. “It’s really important to communicate with the intermediaries or your [colleagues] quickly,” Yawney said. “Everybody appreciates timely communication.”

Because DealCloud’s real estate investment management software comes equipped with traditional CRM capabilities, dealmakers can track and manage their deal flow in the same place they manage relationships with individuals and other firms. With DealCloud’s purpose-built and flexible technology layer, gathering insights across these seemingly disparate data sets is easy to adopt into the CRE investor’s daily workflow.

It’s also important for real estate investors to know CRE best practices concerning:

- Managing the deal pipeline

- Managing relationships with brokers, contractors, and developers

- Maintaining coverage of assets, industries, and strategies across geographies

By using the relationship management features in DealCloud, real estate investors can view and store all broker relationship data in one place, allowing them to better understand and address any issues that may arise.

3. Give dealmakers a competitive advantage

Firms can’t successfully identify and win opportunities unless they leverage their teams’ institutional knowledge. However, many firms still track assets, people, and deal workflows separately, and the data becomes disjointed and siloed. Without investor software to consolidate this information, progress is slowed, and firms risk losing opportunities to their competitors.

DealCloud streamlines workflows by having all property, transaction, and relationship information in one place where it can be viewed simultaneously. This centralization and democratization of data means that teams need no longer waste time context-switching and updating disjointed databases from disparate sources. Instead, team members can use that time to source more profitable deals and build more profitable relationships.

CRE investor software also helps firms mitigate risk. With DealCloud’s conflict management solution, CRE investors accelerate conflict review and resolution by streamlining critical risk-management activities within a unified deal, relationship, and compliance management platform.

Choose a software solution that does it all

Firms that fail to evolve operationally risk falling behind in the competitive CRE market. If you wish to earn the trust of sellers, brokers, and lenders, your firm must invest in tools that will enable it to successfully manage matters and properties with diligent attention, caution, commitment, and care. That means adopting software that enables quick data-backed decision-making.

Most CRE investor tools manage properties, deals, or relationships, but DealCloud goes above and beyond by managing all three in concert. By having all of your information in one place, your firm can properly analyze your assets, deals, and relationships in context with one another, and make better informed decisions.

Schedule a demo to learn more about Intapp DealCloud’s real estate investor software.