During a recent workshop with a major investment bank evaluating our Intapp DealCloud deal and relationship management platform, a managing director identified a key strategic goal: Increase the number of “Tier 1” private equity (PE) sponsors paying the bank significant fees.

When we started discussing how the firm identified and cultivated these key sponsor relationships, it became apparent that they lacked a standardized way to evaluate sponsor relationship strength and determine which relationships to prioritize. It was up to each managing director (MD) to build relationships that would maximize incoming fees with approximately 20 sponsors — without visibility into the firm’s overall coverage stance.

MDs use various tactics to achieve this, including sending emails and meeting with sponsors at industry conferences. But the tactic that emerged as the most effective? Consistently bringing sponsors deals that match their investment preferences.

This workshop highlighted the importance — and the challenges — of providing impactful coverage and building mutually beneficial relationships. Reciprocity is the name of the game: Investment banks show more deals to sponsors, and sponsors reward those banks with more mandates.

Below we dive into the relationship between investment banks and sponsors, why understanding reciprocity can be challenging, and how modern, AI-powered technology platforms address these challenges and optimize coverage.

Relationships and reciprocity challenges explained

So what does this symbiotic relationship look like between investment banks and sponsors?

Investment banks are routinely engaged by PE firms to acquire, finance, refinance, or sell companies. In the case of a highly desired sell-side mandate, one of the first things bankers must do is build a list of prospective corporate and financial acquirers.

As the process unfolds from list creation to outreach, teaser distribution, management presentation, data room, and everything that follows, the bank shares increasingly more information with a shrinking list of potential buyers. These buyers perform various levels of due diligence and decide if they want to proceed in the direction of a definitive agreement. One or more of them will win this process and take a partial, or, more typically, a full ownership stake in the target company.

Now consider the end of this ownership cycle, which could be years after the initial investment. If the winner of the original auction was a PE firm, the firm will ideally have increased the value of the company’s equity and will decide to exit, usually via a sale (versus an IPO). The sponsor and portfolio company C-team will then hire an investment bank to advise on and manage the sale.

It’s an open industry secret that PE firms will typically bring this work to investment banks that have been generous with their balance sheet, equity and debt research resources, and/or sales and trading desks — and have shown them original, actionable deals that match their investment preferences.

Midmarket investment banks usually send teasers to a large cohort of suitable sponsors for each sell-side mandate. As a result, private equity firms often receive hundreds of teasers annually. Given this volume, how can each side understand if they’re achieving reciprocity?

How leading tech provides visibility into reciprocity and helps optimize coverage

Modern AI-powered platforms like Intapp DealCloud, which centralize firmwide intelligence, give bankers and private equity firms the holistic, real-time insights and analytics needed to understand if they’re achieving reciprocity.

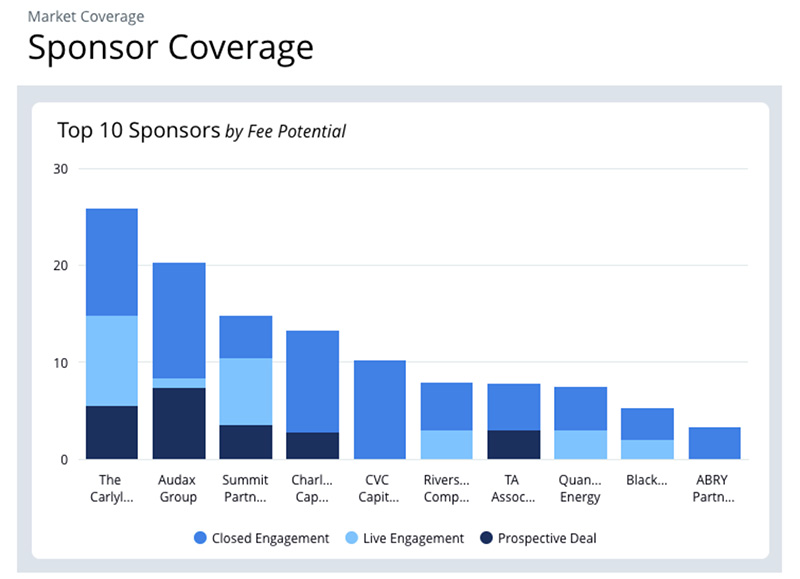

For example, DealCloud coverage dashboards give bankers a firmwide view of how various sponsors compare in terms of fees paid to the bank. This visibility can help leadership identify the most productive sponsors and ensure they’re prioritized by MDs.

DealCloud dashboards can also show PE professionals how many deals have been sent their way.

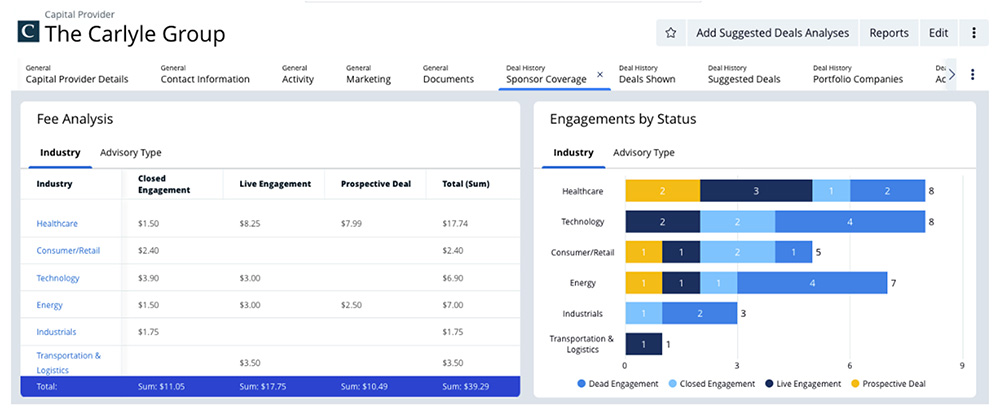

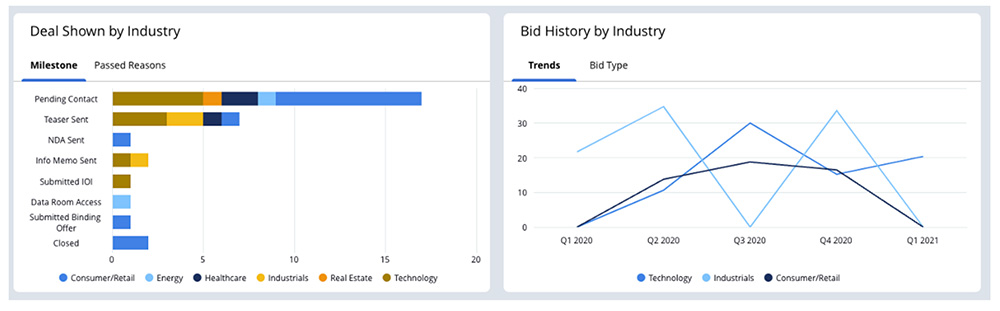

In addition, with DealCloud, users can get insights into how the firm has historically interacted with another firm across a variety of deals. With a few simple clicks, they can see exactly how the process unfolded for a specific deal (e.g., that stage it got to, bid amount, reason for passing). They can also view all recent and historical interactions for a sponsor and individual sponsor contacts. Professionals can even use relationship strength scores to help prioritize outreach and ensure key contacts don’t grow cold.

And with Intapp Assist for DealCloud, dealmakers can provide more impactful coverage with actionable, AI-powered relationship insights, network updates, market news, and auto-generated summaries for sponsors, portfolio companies, deals, and contacts. They can also accelerate deals with features including company recommendations and personalized, AI-generated emails for deal marketing.

These detailed insights and powerful, AI-driven features can be leveraged by MDs to prepare for meetings, decide which deals to bring to sponsors, and provide intelligence that can be used as negotiating leverage to bring in more mandates for the bank.

Drive growth with Intapp DealCloud

More than 1,700 financial services firms worldwide rely on DealCloud to drive growth. Schedule a demo to see how DealCloud can help your teams better understand reciprocity and optimize coverage.