It’s not unusual for private equity (PE) dealmakers to use familiar tools like spreadsheets or a generic CRM for pipeline management. However, these solutions are designed to track linear, one-on-one relationships, and lack industry-specific functionality to properly manage complex deal flows across multiple stakeholders such as investment banks, placement agents, and limited partners.

Using a one-track system can lead to loose ends and, eventually, lost deals. The complex relationships between you, your clients, and your prospects require a dedicated solution. Here are three reasons why dealmakers should ditch the spreadsheets to improve operations, secure data, limit manual processes, and ultimately reduce deal failures.

1. Spreadsheets can’t handle large amounts of data

As the market grows and you attract new investors and expand your portfolio, your data — and its complexity — increases. Spreadsheets work well for collecting and editing small data sets, but storing large data sets in one file can cause unexpected app crashes. Even splitting the data into smaller files can create an unsafe environment for housing vital information: Although it will be easier to share those files, you also increase your risk of misplacing or losing data.

Fragmenting data into disparate files also makes it difficult to monitor the granular details of deal flows, track duplicate entries, and troubleshoot suspicious data. This lack of visibility can hinder internal collaboration as well as banker and investor relationships. For example, multiple team members might mistakenly reach out to a prospect at the same time and impede a potential deal in the process.

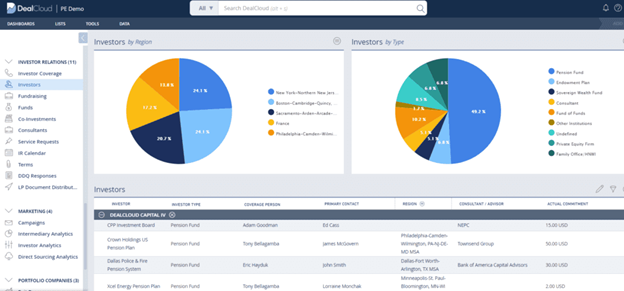

By implementing a pipeline management solution like Intapp DealCloud, which is purpose-built for capital markets professionals, firms can benefit from custom dashboards that provide a clear, holistic view of their deal flows. DealCloud also includes essential CRM functionalities like contact and opportunity management, so you can manage data for multiple deals all in one place.

Source: DealCloud

With DealCloud’s robust search feature, you can quickly look across deals, companies, locations, documents, interactions, and industries. The platform’s de-duplication and merge entries features also help you clean up your data by identifying and combining duplicate records, saving you time and reducing clutter and redundancy.

The DealCloud implementation team works to understand your processes and data sets for a seamless migration away from spreadsheets into a single source of truth. To further simplify your user experience, DealCloud offers support that includes on-demand access to the DealCloud product support team, consultation services, and DealCloud University.

2. Spreadsheets aren’t secure

Whether a deal is still in the pipeline or progressing through the transition stage, deal information is highly confidential — but unfortunately, spreadsheets aren’t secure. Professionals can easily grant the wrong people viewing or editing access, leading to unauthorized data loss or alteration, security breaches, and compliance failures.

With DealCloud, each user has a unique password-protected profile. The permissions, or user management, feature in DealCloud allows administrators to control which users can access certain features and data sets. For example, administrators can limit access to the firm’s fundraising pipeline and investor contact information to only investor relations (IR) team members.

DealCloud also offers a “work-on-behalf-of” feature to allow temporary access to individuals covering for a co-worker. For example, if a principal is unavailable because of meetings or travel, an administrator can permit a vice president to step in and update records on the principal’s behalf, keeping the workflow running smoothly.

Activity logs are viewable by approved administrators, providing visibility into file access and data alterations. By setting up role-based views, permissions, and monitoring, firms can share sensitive data on a need-to-know basis, protect data integrity across the firm, and assure clients that their data is safely stored.

3. Spreadsheets require manual processes

When using spreadsheets, professionals end up performing most tasks manually — including inputting data, tracking deals, following up with prospects, and generating reports. They may also need to gather and aggregate data from multiple disparate files, wasting valuable time better spent on deal sourcing, research and development, and transaction execution.

With DealCloud, your firm can automate parts of your deal flow to save time and improve efficiency, thanks to tools like custom deal flow reports and analytics, which are accessible via both desktop and mobile app.

“We use DealCloud to do weekly check-ins to get a good feel for the different activity that we have from an M&A standpoint,” said Jeremy Segal, Executive Vice President of Corporate Development at Progress Software. “Which companies do we want to reach out to? Which companies did we have dialogue with? Which companies could move down the funnel into potentially being prime M&A targets for us?”

Segal continued: “Historically, Progress Software used spreadsheets to manage its deal flow, and it’s just not effective. With the DealCloud tool, not only can we manage our deal activity, but we can report out with really cool graphics and data that our board and executive team really appreciate.”

DealCloud also alleviates administrative burden by letting you schedule automatically generated reports as a Microsoft Word document or PDF. Gone are the days of frantically pulling updates before weekly check-ins.

Purpose-built software improves deal success rates

Every interaction with clients and prospects needs attention and care. DealCloud meets your current and future deal management needs by serving as a single source of truth for data, relationship, and pipeline management. The connectivity and data consolidation that DealCloud provides also lets you broker deals faster. With the ability to view and contribute to your DealCloud database from anywhere, your firm comes off as a great potential partner.

“[Spreadsheets don’t] cut it anymore,” said Paola Yawney, Head of Business Development at Balfour Pacific Capital. “[DealCloud] is built for private equity by people who are knowledgeable about private equity.”

Ready to explore the pipeline management solution built with capital markets data use in mind? Schedule a demo of Intapp DealCloud today.