Talent management and recruiting are now key areas of focus for capital markets firms, according to new data from private equity advisor BluWave. In fact, their most recent study shows that “the top three categories for value creation investment in 2020 Q2 were executive and staff recruiting, hiring interim leadership and growth/go-to market strategy.” This new trend comes in response to the COVID-19 pandemic and related industry disruptions. With the recent spotlight placed on diversity and inclusion throughout the global economy, many financial services firms are also dedicating additional budget and other resources towards ensuring that the firm’s internal hiring operations are optimized.

“The data shows that people matter now more than ever,” said Sean Mooney, CEO of BluWave and former private equity investor with SFW Capital Partners. “Despite the uncertainty of the current environment, private equity has increased its efforts to hire top talent — engaging recruiters and offering more flexible contracts in hopes of scooping up talent which was largely unavailable prior to the crisis. At the same time, private equity firms are digitizing portfolio company operations so they can collect data to inform critical business decisions. We expect both trends to continue for years to come as competition in private equity forces firms to invest across all functional areas.”

Given the ever-growing list of competing interests and priorities at firms (especially smaller boutiques without HR or Human Capital Management [HCM] teams), how should deal professionals be thinking about and tackling the talent management challenge? See below for our top three tips.

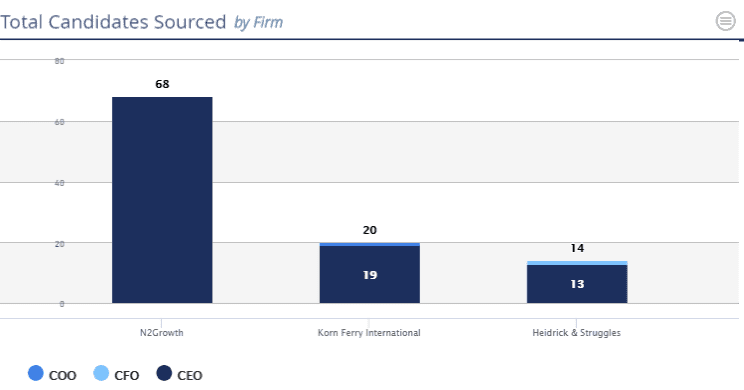

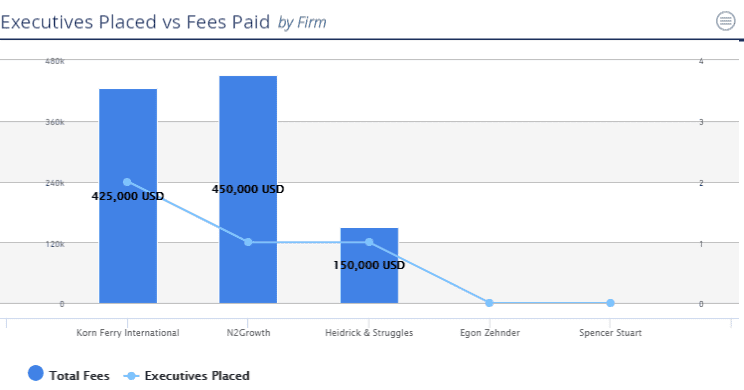

Maintain oversight on third-party, consultant, and executive search firm spending and their outcomes

For firms that do not have an internal employee dedicated to talent management, it’s quite common for them to work with a third-party firm, individual, or team of consultants to find top talent for the firm itself but also for key roles within the portfolio. In fact, given the sheer volume of upheaval caused by COVID-19, most firms need to hire third-party recruiting and talent management support even when they have the resources internally.

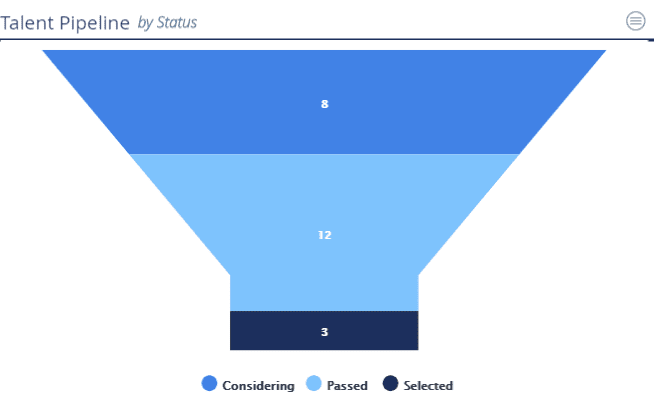

Tracking the work performed by, and the outcomes of, these third-party firms is crucial. Consultants can help capital markets firms attract and retain top talent, but if the firm doesn’t have visibility into their efforts, their pipelines, or their successes, it can be extremely hard to rationalize the fees that they charge in exchange for their services. We suggest using technology to maintain visibility on a few key items seen below.

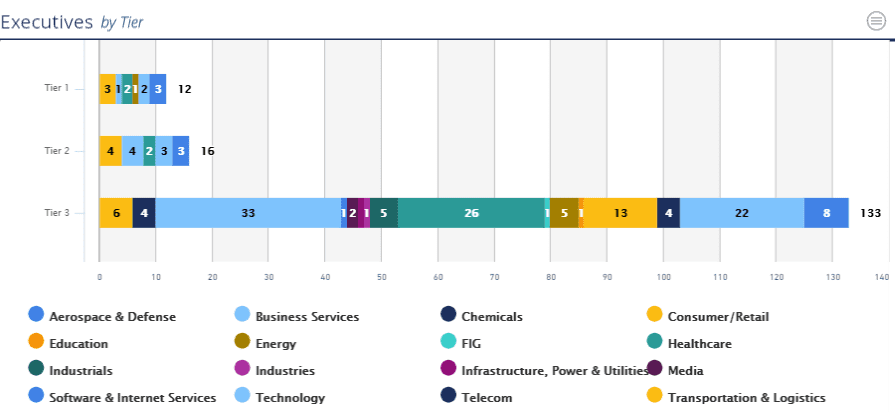

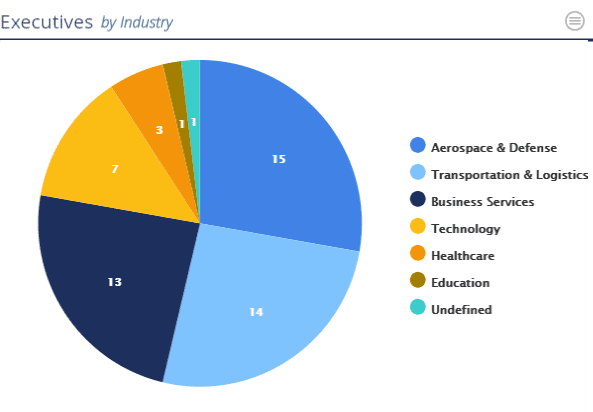

Categorize talent in a way that support the firm’s unique goals

Whether you work at an industry agnostic firm or specialize in one niche market, it’s important that your firm have the ability to understand the unique insights and perspectives prospective employees can bring to the firm. By categorizing these candidates using intelligent tagging technologies, your firm will more easily be able to tap into the pool of available talent and quickly decide who is a good fit, and who isn’t. This strategy is much-preferred by dealmakers who often cite the pain of combing through dozens of LinkedIn profiles or out-of-date spreadsheets to find potential applicants.

Especially when recruiting executive talent, categories and groupings are vital. Your firm may, for example, want to tag all CEOs who have taken a company from private to public, or tag certain CFOs who have experience leading medical device companies. By building these categories into your firm’s centralized data platform (CRM, or otherwise), your firm is able to build institutional knowledge on its talent network, rather than scrambling for information every time a requisition is opened. Over time, and with good data governance practices, this categorization strategy will also help the firm manage a more sophisticated interview and diligence process with each candidate, and in turn, increase the likelihood that they will want to work at your firm, or in the firm’s portfolio companies.

Be sure to work with your HR and recruiting partners to come up with meaningful strategies for tracking and ensuring that the talent pool your firm speaks to is diverse and inclusive, as well. A recent TechCrunch article found that 81% of venture capital firms don’t have a single black investor, so, if the firm’s goal is to change that, the first step is tracking and improving the firm’s data on its talent network.

Keep a record of every interview process and be thoughtful about the pipeline

Whether your firm has lots of open roles, or simply fills a handful of executive roles each year, a key component of a successful private equity talent management program is that the firm keep tabs on every process, regardless of the outcome. Even more importantly, as the candidate moves through the pipeline, the firm needs to have visibility. Even if a top COO candidate ends up passing on an opportunity at your firm or at one of the portfolio companies, having an understanding of why they passed will help you better match them to another opportunity in the future. Since it’s not uncommon for executives to switch companies every 3-10 years, this data can be extremely helpful and will only build over time.

Getting started

If your firm is seeking assistance in setting up and maintaining a best-in-class talent management program, be sure to speak to the DealCloud team. We can show you countless workflows and processes that have been installed at other private equity, investment bank, and other capital markets firms. Click here to schedule a consultation with our team today.