More than 90% of limited partners (LPs) predict that the private markets will continue to outperform the public market. Many feel that private equity offers the best returns, and they’re hungry to invest in alternative assets.

With this demand, acquisitive firms presumably shouldn’t have trouble raising funds or generating returns. Unfortunately, competition for these LPs and their loyalty has increased along with the supply. To generate the best returns, general partners (GPs) must find and collaborate with ideal LPs for their funds.

A good investor pipeline saves time on fundraising and allows more focus on important tasks. These tasks include finding deals, executing them, and managing portfolio companies. Learn how GPs can effectively improve their investor pipelines to better deliver results.

Fill Your Investor Pipeline with Profitable New LP Relationships

Find or create the ideal LPs for your pipeline with a clear investment thesis and documented wins.

A strong investment thesis details more than just your target private companies; it also describes your ideal investor. Before your next roadshow, make sure to review your investment thesis. Ensure that it is clear, brief, correct, and reflects any relevant internal or market changes. Include criteria for what you consider to be a suitable LP, such as:

- Minimum capital commitment

- Geography

- ESG philosophy

- History

- Hold period and time horizon expectations

- Preferred exit strategies

- Level of hands-on involvement the LP envisions having in portco management

Keep track of your firm’s achievements and collect vital information in a single location for easy access by new investors. Ask your analysts to pull key statistics from investor reports regularly sent to your current LPs.

Once you’ve established your thesis and win documentation, your intermediaries can help introduce you to new LPs; alternatively, you can introduce yourself to experienced GPs from big firms who have joined or started their own co-managing firms. Journalists at Private equity Wire report that LPs are flocking to these new co-managers like never before.

Another way to find and meet new, profitable LPs with uncommitted capital is to look up similar portfolio companies and their recent exits to discover who invested in which deals. You can also create LPs by convincing venture capitalists (VCs) to switch to LPs. Ben Choi, a VC-turned-LP, revealed that if your investment thesis aligns with a VC’s goals and values, you should definitely pursue a GP and LP collaboration. The trick to landing these collaborations is creating a strong, positive relationship with the VC, then presenting your mutual goals in a compelling way.

“LPs are in the business of picking managers,” Choi told Kauffman Fellows. “If the managers don’t get along, for example, then there is a lot of lost energy that would otherwise be spent investing. An important part of the pitch is how and why you will stay together.”

Develop LPs to Refill Your Investor Pipeline

Your pipeline’s success shouldn’t only rely on new LPs; you should also motivate previous investors to invest in your fund again. Since you already know how these companies operate and how much capital they have, you can facilitate smooth raises and executions while continuing to build on existing relationships.

Keep Your Current LPs More Informed

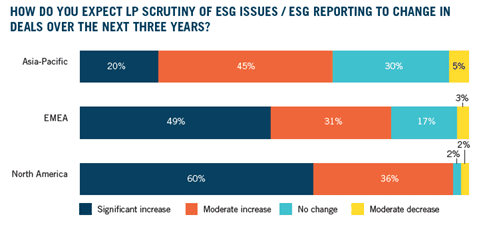

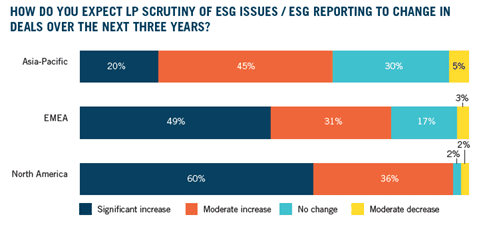

To encourage repeat commidealtments, it’s imperative to improve your investor reporting. LPs are increasingly interested in what’s going on at your firm and within portcos. Regarding environmental, social, and governmental (ESG) issues alone, 96% of North American GPs expect LP scrutiny to increase.

Source: Dechert’s 2022 Global Private equity Outlook

Get ahead of this anticipated increase by upgrading your reporting capabilities and processes.

Let Your Current LPs Play a More Active Role

When you include investors in managing a company, you give them a feeling of ownership. This also helps improve your relationships with investors and makes it easier to raise funds in the future. Include LPs in your operational improvements. Inform them before and after management teams make changes. This will boost portco cash flow or create new products.

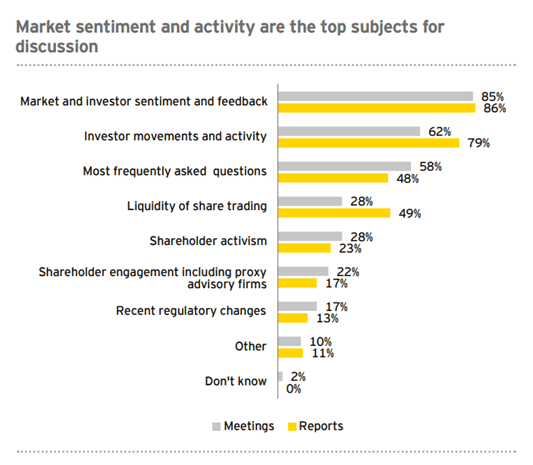

Your investor relations team should share feedback from investors with the boards of your GPs and portcos. They should not only pass on information from GPs to investors. EY’s Investor Relations Survey revealed that 77% of private equity firms regularly have investor relations (IR) representatives attend board meetings, usually to discuss market sentiment and investor activity.

Source: EY Investor Relations Survey

Report to your portcos’ boards about evolving investor behavior, sentiment, and values as a way of involving LPs in your company management.

Mine Your Investor Pipeline for Data to Move LPs Through Your Processes

Your firm’s investor pipeline contains mountains of data, most of which is typically untapped. Capture, extract, and use this data to spur relationships forward in your investor pipeline.

Use a Private equity–Specific CRM to Expose the Most Promising Investor Relationships

To gain valuable insights, use data to understand the importance of relationships and the urgency of each deal or partner’s coverage. These insights can help you keep relationships moving toward repeat closes.

To obtain key insights, you’ll need a CRM purpose-built for dealmakers and their needs. All CRMs store investor contact details, but only Intapp DealCloud has customizable scoring to prioritize the most important investor relationships. Relationship data you can rank and prioritize with DealCloud include:

- Investors’ Track Records — Score investor relationships automatically by whether they’ve invested with your team before. This is often a high-ranking factor for firms.

- Relationship Investment — Understand how much your team already invested into a relationship. If, for example, you’ve scheduled a management presentation for an investor, you can factor that in and weigh the importance of that factor when creating the relationship score.

- Curiosity Towards a Particular Fund — Evaluate investors’ engagement. If an investor shows interest, it may improve the relationship score, depending on how important it is to your company.

DealCloud lets you score these aspects to automatically rank relationships, letting you focus on the relationships that show the most promise for both current deals and future raises. This keeps LPs moving through your process without the bottleneck of constant subjective assessments and discussions.

Use Relationship Intelligence Data to Focus Your Team’s Activities

First, determine the key relationships for your firm based on its values. Then, you can determine the most effective way to engage with the top investors.

Source: DealCloud

DealCloud’s integrated Relationship Intelligence solution can help you better engage with your firm’s network by providing the following insights:

- Connections — Learn who knows whom within firms. LPs who have not invested in your fund before may still have a connection to someone at your firm. This could be a principal or an executive they went to school with. Scoring this factor highly may prompt a catch-up call or email.

- Recency — Check how much time has passed since someone contacted a potential future investor, and consider setting a meeting.

- Impactful Activities — Determine which activities have historically prompted more movement. One person may have donated money to your fund after having a meal with your team. Another person, however, may have decided to invest elsewhere after receiving multiple phone calls from someone at your company. After noticing this pattern, you might choose to focus on meals, activities, and meetings to help investors move forward.

A specialized CRM for private equity allows your team to utilize past relationship data. This can help in closing more deals and raising more funds.

A Healthy Investor Pipeline is the Answer to Today’s LP Activity

Despite 2 years of pandemic-induced volatility, LPs want to invest now more than ever.

During the global financial crisis in 2008, numerous investors decided to withdraw from private investments. As a result, they missed out on the subsequent recovery, as stated by McKinsey analysts. “This time, most LPs seem to have learned from history, as investor appetite for private equity appears relatively undiminished following the turbulence of the last year.”

To participate in the enthusiastic commitments of LPs, you must continually nurture your investor pipeline. Analyze your pipeline data to find ways to engage both new and familiar relationships for efficient, mutually profitable deals.

Ready to try a CRM that’s custom-built to help your firm improve its investor pipeline? Schedule a demo with Intapp.