For general partner (GP) firms navigating the uncharted waters of 2022, it’s essential to keep an eye on emerging private equity trends. Analyzing private equity trends and statistics can provide your firm with actionable insights on how to improve and remain competitive within the evolving market. However, it can be difficult to find time in your busy schedule to read and analyze the valuable, in-depth reports published by the Big Four and their counterparts.

Luckily, we’ve got you covered. Check out the nine most significant private equity trends emerging now for capital markets professionals and plan your firm’s next steps towards becoming a best-in-class organization.

1. 27% of dealmakers are making larger acquisitions than they’re typically comfortable with

Dry powder, valuations, and market pressure have increased — and so, in turn, have expectation for GPs to allocate their committed capital. The autumn 2021 edition of the Dealmaker Pulse Survey revealed that more than a quarter of sponsoring firms are buying more equity than they would under other circumstances.

These high-performance benchmarks weigh heavily. Tony Hill, Vice President of Business Development at Trivest, said, “For the last few years, [Trivest has] been on an unprecedented expansion trajectory — and that’s by design. We really wanted to evolve from being just a smaller, lower-midmarket [private equity] firm to being a multi-fund, multi-city, multi-country operation.”

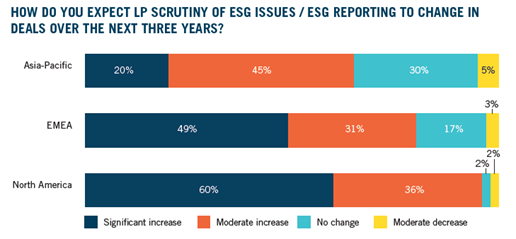

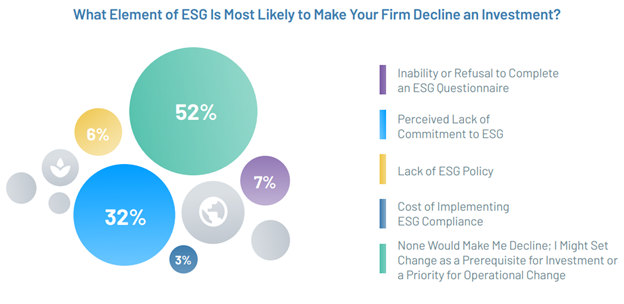

2. 96% of private equity leaders expect LPs to want more (and better) ESG reporting

Previously, many private equity firms viewed environmental, social, and governance (ESG) issues as a responsibility. Now, leaders are beginning to treat ESG as the competitive advantage it really is: 48% of limited partners (LPs) and dealmakers say they’d decline to complete a transaction if an acquisition target failed to align on ESG issues. An additional 52% would consider making ESG-related change a prerequisite for investment or an operational priority.

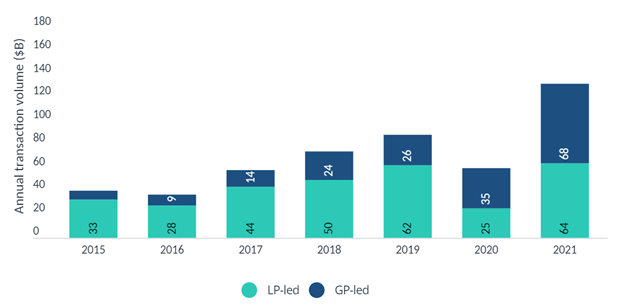

3. GP-led deals nearly doubled in 2021 amid surging secondary transactions

Secondaries were increasing in popularity before the events of 2020 and 2021. As with many trends, we saw a decline in secondary deals, followed by a roaring recovery to solidify the upward trajectory. The notoriously complex transaction structures of the secondary market provide value and liquidity solutions that no other exit delivers, and dealmakers are capitalizing.

Most notable here isn’t the increase in secondary transactions, but rather the evolution of them. When GPs initiate the sale, they’re offering LPs early liquidity options during a binding election period. The new LP (the secondary buyer) now owns the original fund interests.

Private equity firms have a lot to learn about customer retention, but this creativity and flexibility shows that leading GPs are stepping up to provide customized options to their clients. It’s a short-term move that has long-lasting relational benefits.

4. Private equity firms outnumber hedge fund managers for the first time in history

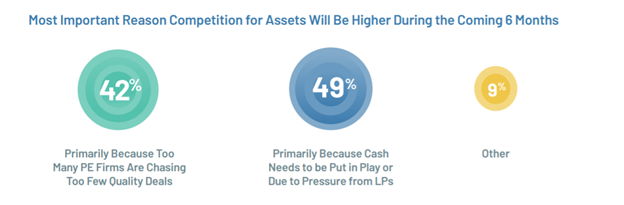

Competition has increased: There are now more private equity companies than ever before, and GPs now outnumber hedge fund managers.

Private equity firms are paying more for businesses than ever before, according to Harvard Business Review (HBR) analysts. Why? According to the Dealmaker Pulse Survey, GPs know that competition is hot, and that if one leader doesn’t scoop up an investment opportunity, another one will.

However, GPs that jump at every new investment opportunity risk lower potential returns. Instead of taking as many opportunities as quickly as possible, focus on deal sourcing through your current networks. Check in on contacts who haven’t heard from your team in a while: Doing so will improve your firm’s relationship-building efforts, so you’ll hear about the best deals first.

5. Technology bets doubled

Harvard Law School’s Forum on Corporate Governance reports that in 2020, the private equity sector announced $196 billion in successful technology acquisitions. In 2021, that amount more than doubled to $400 billion.

Acquisitions in the technology space will likely double again within a year or two due to technology’s strong impact on all other sectors. No industry operates or innovates without evolving tools, and the demand for safer, more robust engineering will continue to drive abundant deal volumes with high values.

Competition in technology will rely on a firm’s connections, deal flow, and deal velocity. Create and strengthen relationships in the tech sector, no matter your industry.

6. 41% of dealmakers say recruiting outside talent is a top challenge

According to the autumn 2021 Dealmaker Pulse Survey, “Talent concerns have shifted significantly, with a growing number of respondents — 41% up from 30% 6 months ago — admitting that recruiting and hiring outside talent has become their greatest talent issue.”

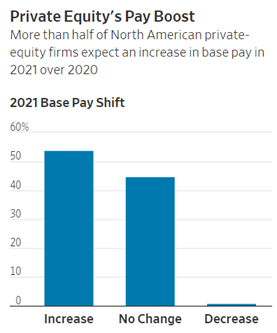

In response to this increasing demand for the best talent, another trend has emerged: Private equity pay increased last year, according to a survey conducted by Heidrick & Struggles International. However, private equity leaders often get complacent about employee engagement and retention, and risk losing the very talent they worked so hard to bring onboard.

Prioritize retaining your talent: Consider conducting an anonymous employee engagement survey to learn where your team’s pinch points are, then address those frustrations.

7. Transportation Services Index (TSI) reaches 135.8

Supply chains are back to pre-pandemic efficiencies, as indicated by the U.S. Bureau of Transportation Statistics’ Transportation Services Index (TSI). This marker reveals how much freight logistics companies are successfully moving across the country.

We can likely expect “revenge spending” on businesses that suddenly see an influx of production capacity due to renewed and even improved logistics. We’ll also see a renewed commitment to crisis response planning and preparedness among private companies, and rebound or rebuilding of supply-chain-reliant business models. Private equity firms can potentially devote some business development resources to this opportunity.

8. Average fund performance doubled and tripled

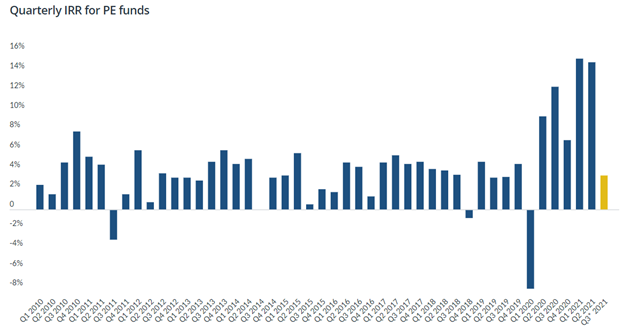

The COVID-19 pandemic led to low interest rates, an influx of new business formations, and a disruption of many legacy businesses and practices — and ultimately paved the way for buy-low, sell-high success. PitchBook data reveals that, in general, quarterly internal rates of return (IRR) have doubled and tripled in the last 18 months.

Although this spike in IRRs is impressive, it’s too early to tell whether it will last and become a trend. Private equity leaders must wait and carefully observe IRRs before making any decisions around funding.

9. Time horizon fluctuations cease

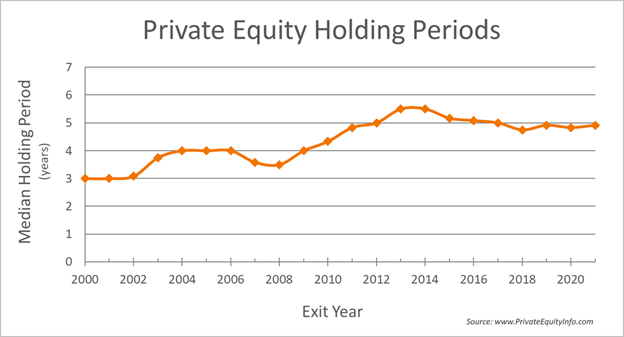

The hold periods for portfolio companies (portcos) have stabilized after 15 years of variability, proving that not all private equity trends present like a hockey stick.

From 2008 to 2013, an upward trend emerged: Portcos were allowed increasing amounts of time to improve operations, financials, and their valuations. However, the industry has since matured, and most private equity teams now have a moderate 5-year hold time.

Private equity firms have always walked a fine line between short-term and long-term strategy and tactics. London Business School’s Dominic Houlder and Nandu Nandkishore call this medium-term thinking. “The medium-term is where companies are shaped,” they said during an HBR webinar.

Navigate the private equity trends of 2022

Observing and analyzing current developments in the private equity sector can help leaders navigate an uncertain environment and make the best decisions for their firms. For ultimate visibility into these trends, consider adopting Intapp DealCloud, a system that handles deal, people, and relationship information all at once.

Schedule a demo today to see how Intapp DealCloud can help your firm best contend with private equity trends.