Last year we met with over 1,300 firms including PE fund managers, investment bankers, lenders and corporate development professionals, and consistently found that the most successful deal makers are systematic in their approach to both inbound and outbound business development. Given the recent changes in the market, taking a systematic approach is much easier said than done.

These complexities make for more challenging – and perhaps more importantly, more expensive – deal processes than ever before, prompting buyers, sellers and bankers alike to be more bullish in their efforts. According to Bain & Company’s 2017 Global Private equity Report, since 2012, the count of global buyout deals decreased at a rate of 9% annually, while deal value rose at a 6% compound annual growth rate – meaning competition is at an all-time high. Listed below are the top six trends we’re tracking that are impacting effectiveness in the PE market:

1. Strategic Buyers are on the Prowl

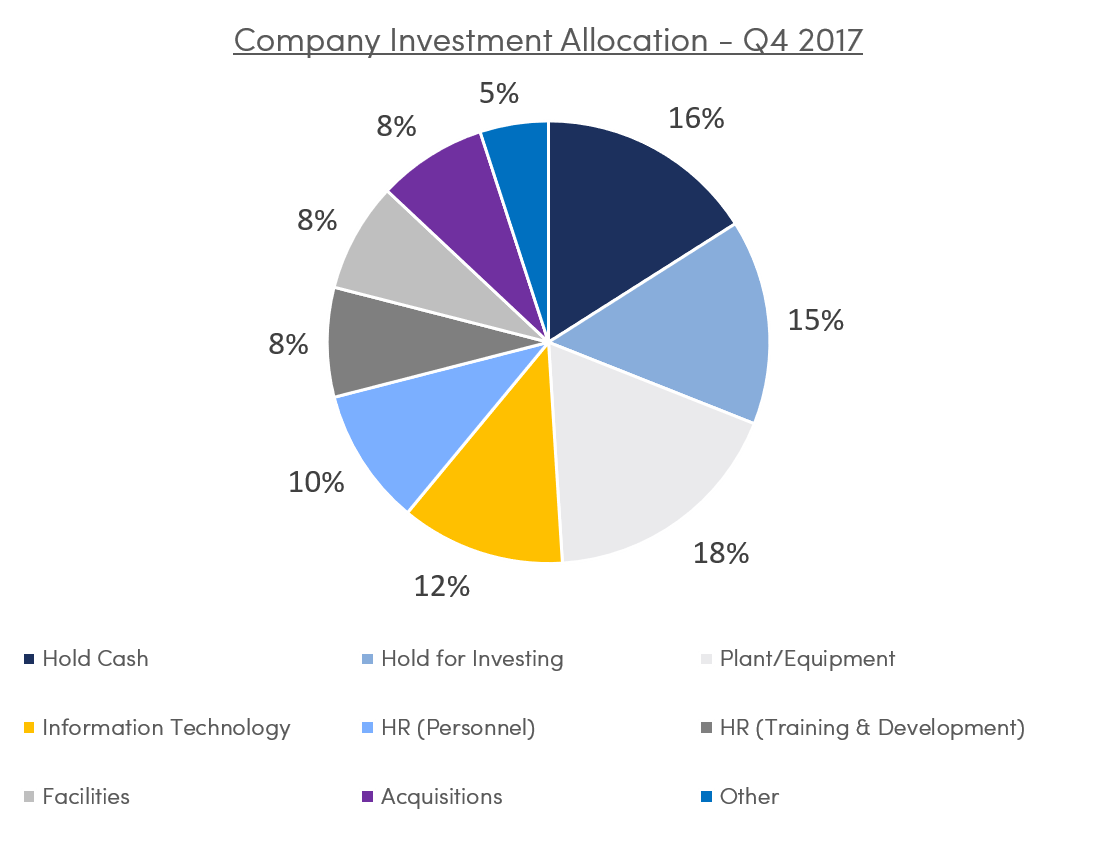

Strategic acquirers/corporations continue to bring unmatched buying power to the negotiating table. Since it’s not just Fortune 1000 companies seeking acquisitions anymore, private equity’s share of deals is at an all time low. According to the National Center for the Middle Market’s recent report, 75% of companies reported positive revenue growth in Q4 2017. While 22% of the companies say they are highly likely to add a new plant or facility in 2018, 8% cited plans to make an acquisition.

2. Non-traditional buyer prevalence continues

With the emergence of family offices, independent sponsors, individual investors and search funds in the market, even the most sophisticated investment banking firms are struggling to keep up with the number of players the industry. This means that deal processes will continue to vary wildly (from broad auction to private process and fireside chats), depending on the type of buyer and the complexity of the deal. The increasing abundance of information about private companies has lowered the barriers to entry into the marketplace, making it easier for these one-man-shops and breakaway firms to be successful. Investors are increasingly committing to these less traditional funds with the hope of getting access to a more flexible investment vehicle, and of course, higher returns.

3. Relationships rely on processes

With proprietary deals so hard to come by, the most effective way to tackle the ever-changing private equity landscape is to have a dedicated and defined effort towards relationship management in support of business development. It’s true that buying power is extremely influential in a deal process, but so are relationships and deep understanding of an industry and exit motivations. Certain closely-held relationships cannot be disputed, but given the vast pool of players in the market, CRM systems are a necessity for ensuring important contacts get the attention they need. Strong systems with processes like cataloging historic data about portfolio companies and management teams, using predictive analytics to assemble call lists, and seamlessly integrating deal execution information with the firms broader business development and coverage efforts lead to more shots on goal and to fewer failed deals.

4. A good BD strategy starts with a strong technology infrastructure

The aforementioned fragmentation of the market is the driving force for business development and relationship making, and buyers need to leverage technology to ensure they are spending time with the right deal sources. Proper coverage ensures they’ll get the call when a deal goes to market. Similarly, bankers need data sources to be reliable enough to confidently compile buyers lists and execute efficient deal marketing processes. Today’s top firms, when compiling the initial list of acquirers, are looking at several variables such as whether a company had ever pursued an acquisition in this industry, their past behavior in prior deals and if there is a true angle to help management teams achieve their goals. Harnessing these analytics are key to bankers’ ability to generate premium outcomes for their clients. The most successful firms are those who embrace this trend, invest in the technology to support the effort, and learn to work smarter, not harder.

5. Dry Powder is at an all-time high

The demand for privately-owned, family-backed or well-performing businesses in the United States is grossly outnumbered by the demand for such assets. In fact, there’s currently an estimated $1.4 trillion in cash reserves — an all time high level up 13 percent year-over-year. As the dry powder figures continue to swell, the number of available assets remains stagnant or with small increases year-over-year. Nonetheless, buyers and bankers alike will continue to hope (fingers crossed, everyone!) that the baby boomer generation will begin seeking an exit soon. Investors are wise to think critically about plans for future fundraising as to not become overcapitalized.

6. Interest rates remain stable (for now)

Despite an uncertain interest rate climate, lenders are working diligently to access deals brought to market by private equity firms and corporations alike. While it’s clear that the recent exit of Federal Reserve Chair Janet Yellen and the introduction of Jay Powell will not cause panic in the marketplace, it also seems clear that acquisition financing and other debt products won’t become cheaper any time soon. The private credit landscape continues to grow rapidly, increasing from $207 billion of NAV in 2010 to $374 billion of NAV in 2017. Over the past few years the number of new private credit firms and non-bank lenders has dramatically risen. Private credit has been the real star when you consider its outperformance against any other type of credit alternative. Effective BD strategies include building deep and broad relationship with many debt financing providers. Buyers and bankers are taking the same strategic approach to covering and managing these relationships as they are with the target companies in their pipeline. If the recent market volatility continues, buyers and bankers are wise to maintain existing lender relationships and remain open to new ones.