Performing due diligence can be a lengthy and disorganized process if your firm doesn’t have the most up-to-date tools and cloud-based software at its disposal. Due diligence software offers firms a faster and more reliable way to perform due diligence requests. Using DealCloud, a purpose-built deal and relationship management platform, firms can utilize data, streamline due diligence, and enhance the dealmaking process. DealCloud users can also create customizable and flexible dashboards that align with their firms’ unique needs, making complex due diligence processes much easier to manage.

In this article, we’ll discuss the importance of centralizing firmwide due diligence data, improving due diligence workflows with automation, and ensuring the safety of due diligence information with airtight security features.

1. Due Diligence Software Centralizes Data

Due diligence is a broad term that encompasses many different processes and depends on the size, scope, and strategy of the firm performing it. Because every deal is unique, it’s important that your firm documents and centralizes these processes. When the global pandemic hit in 2020, dealmakers needed to find ways to remotely conduct due diligence, and many of them turned to DealCloud. By leveraging DealCloud’s advanced due diligence software, dealmakers can manage assessments, financial diligence, environmental, social, and corporate governance (ESG) diligence, and other diligence checklist items.

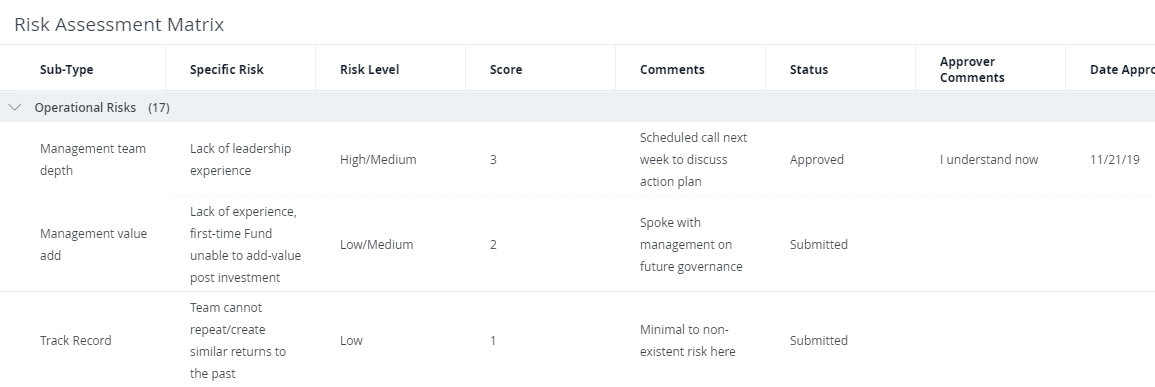

Firms can additionally leverage tools such as a Risk Assessment dashboard, which provides a matrix that shows risk sub-types, including operational risks, market risks, infrastructure risks (in a target region or country), and fund-specific risks. Users can dive deeper into each risk sub-type to learn about the specific risk and risk level. Dealmakers can also see who performed the diligence on which item, when they performed it, if there were subject matter experts involved, and if there is any documentation related to that process.

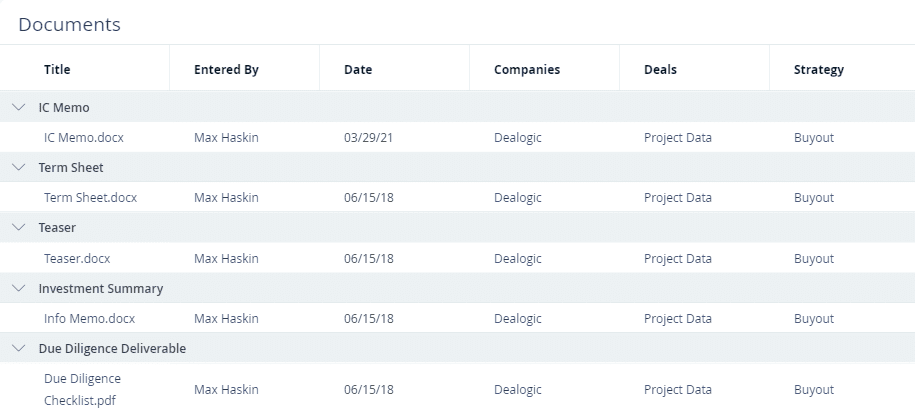

To review high-level deal details, firms can utilize tools such as a Deal Details dashboard. This dashboard covers the general financial information for investments, including credit ratings from S&P Global Market Intelligence and Moody’s, the company’s revenue, and EBITDA. Similarly, firms can create a Documents dashboard for each deal and diligence process that centrally stores documents such as financial models, term sheets, investment summaries, due diligence deliverables, and other materials. As the firm executes on more and more transactions over time, these documents and the proprietary information housed within the due diligence report software become a vital resource for dealmakers to grow their knowledge in a specific industry or with companies of a certain size.

According to DealCloud’s most recent Dealmaker Pulse Survey Report, 99% of dealmakers agree that diligence and measurement of ESG metrics have increased or stayed the same over the last 6 months. The problem for many dealmakers, however, is that they lack a purpose-built, centralized system to help them manage that diligence and measurement.

DealCloud’s due diligence software enables firms to manage and improve their ESG efforts with dashboards that showcase all data and initiatives related to impact investing, including diversity and inclusion, and industry-dependent topics such as energy management, political risk, and environmental risk. Having direct access to all these important data points improves the due diligence process for you and your team.

2. Automated Workflows Improve Due Diligence

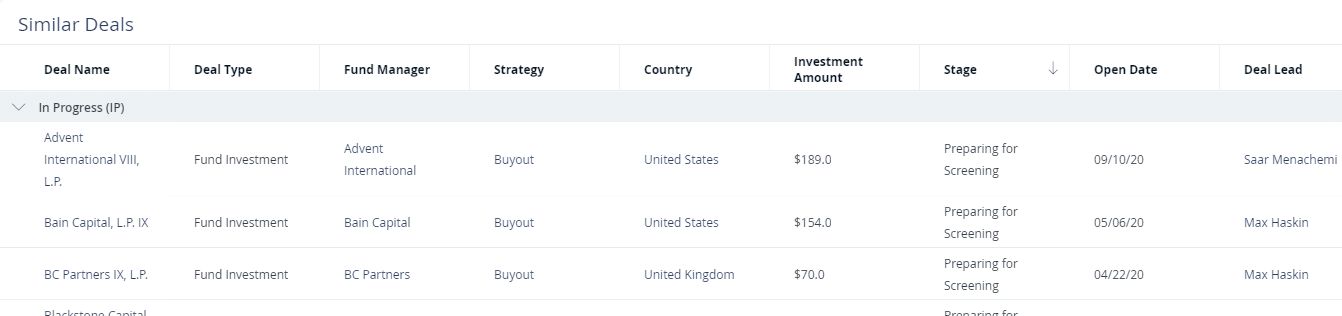

When performing due diligence requests, dealmakers need to be able to easily access firmwide data. DealCloud allows firms to securely store its data in an organized, easy-to-find way. This eliminates the need to create excess Microsoft Excel spreadsheets and Microsoft Word documents that users can’t easily use to compare data. Using DealCloud dashboards such as Similar Deals (below), firms can review similar deals in their database, learn from past outcomes, and filter by deal stage — specifically, whether a deal is in progress, completed, or declined.

To minimize risk and maximize value for investors, firms need to continuously improve their due diligence processes. One of the ways to improve the due diligence process is to automate workflow, as it eliminates many time-consuming tasks that account for performing due diligence requests. DealCloud automates workflows in the due diligence process, allowing users to see historical data within their database and reducing the administrative burden of creating and managing checklists and assignments for each deal.

DealCloud users can also utilize Dispatch, DealCloud’s marketing software, to create due diligence questionnaires using the software’s Pages functionality. Dispatch Pages lets users build custom-tailored content for landing pages and web forms. Once the firm deploys these landing pages or web forms, all submissions and inputs it receives will flow directly to DealCloud.

3. Cloud-Based Platforms Require Airtight Security

Today’s capital markets firms operate in a highly competitive marketplace. In this client-empowered era, firm leaders need to be well-prepared to deal with growing client expectations and increased competitive pressures. DealCloud’s solutions help capital markets firms deliver greater value throughout the deal and engagement life cycle, from winning new business to growing existing market share. DealCloud enables firms to securely access cutting-edge technology from any device or location while providing the necessary agility, flexibility, and scalability to respond quickly and effectively to challenges.

DealCloud employs a broad range of security measures and best practices to secure all client data and the platform itself. Through a structurally sound framework — which DealCloud tests annually to the highest standards of security — we provide a highly functional and trusted solution that can both defend against and react to the myriad cybersecurity threats that exist today.

In addition to the significant protection provided by Microsoft Azure, DealCloud implements security best practices and compliance measures, and hires third-party auditors to review and confirm these controls. This helps DealCloud maintain high integrity when it comes to data privacy and data protection in accordance with the latest regulations.

To learn how DealCloud can support your due diligence efforts, schedule a demo.