Junior investment bankers have long been expected to work hard and pay their dues. For decades, 15-hour workdays have become typical for these young professionals, with many working 7 days a week in order to keep up with a booming financial market. Long hours and challenging projects have become even more difficult as junior bankers have had to adjust to the isolation of working from home in the pandemic and now in an uncertain post-COVID world.

Recently, an anonymous group of 13 first-year analysts at Goldman Sachs released a slide-deck that detailed how the grueling hours and intense pressure of the role was taking a toll on their mental and physical health. The deck made it clear that junior investment bankers are no longer accepting exhaustion as simply, “part of the job,” but rather long for the in-office collaboration, mentorship, and apprenticeship they were once promised. This inspired many other young bankers to speak out about their own experiences, causing investment banks to take notice and reconsider the way they were assigning work to their analysts, associates, and other junior staff members.

While some banks are attempting to break the status quo by offering perks such as Peloton bikes, bonuses, and more flexible hours to their junior bankers, there is still more that can be done to avoid burnout and provide junior bankers with a more livable work/life balance.

In this article, we review two tactical ways investment banks can leverage purpose-built technology to implement meaningful workflow changes that will benefit everyone, especially junior bankers.

1. Automate and operationalize the reporting function

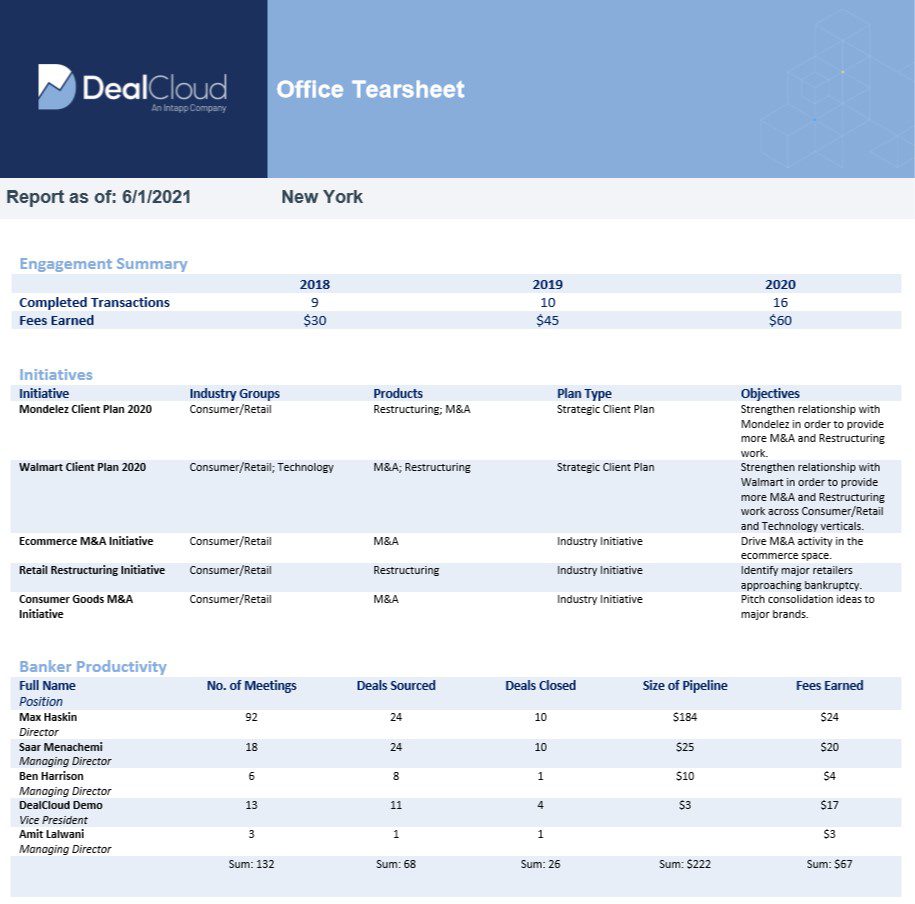

By implementing a deal and relationship management solution like Intapp DealCloud, investment banks can build more robust custom reporting function that automatically delivers vital information with the click of a button. By automating your reporting capabilities rather than pulling and analyzing data yourself, you can save time and avoid unnecessary meetings or Zoom calls.

For example, firms can build templated reports like weekly deal tear sheets by leveraging scheduled report functionality. Bankers can then use these reports to replace or increase the efficiency of the weekly pipeline meetings. Bankers can also set their own cadence for these reports using the DealCloud Microsoft Word Add In and automatically send information to team member’s inboxes when they need it.

To start on this type of initiative, banks only need to monitor the reports being requested by senior leadership for a few weeks to a month. If those reports can be standardized, they can then be duplicated quickly for certain deal types, industries, senior bankers, sponsors, etc. By standardizing these reports, junior bankers can spend less time copying and pasting information for senior relationship managers and spend more time learning how transactions and client matters are managed.

Automating this information also gives junior bankers critical time back in their day and allows them to cut down on virtual meetings that may be contributing to Zoom fatigue.

2. Configure notifications for real-time deal updates

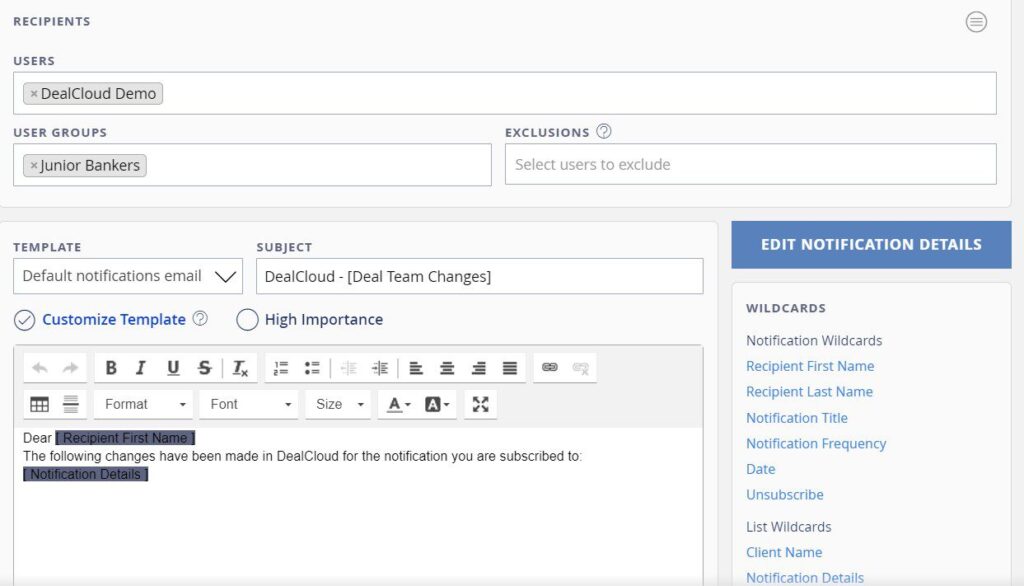

Rather than setting up meetings to discuss the evolving stages of transactions, investment banks like Raymond James, FMI Capital Advisors, and Cassel Salpeter utilize DealCloud’s notification engine to send deal updates directly to your team’s inbox or mobile device. By providing their teams with updates at a set time or based on a specific change in the data, their firms are able to build more firmwide unity and transparency while saving time that would otherwise be spent syncing on the information you receive.

Dealmakers and bankers can easily configure these notifications to be sent at a preferred cadence. Alternatively, bankers can configure notifications so that they are triggered whenever a deal stage, status, size, or owner changes outside of that cadence. Of course, bankers can adjust the notification engine settings to choose the type and length of information they want dealmakers to receive including deal stage, industry, firm source, deal status, why a deal died, and more. What makes these notifications so valuable is that all data within the alert is hyperlinked so recipients can easily drill down into dashboards and reports within DealCloud where more detail can be found.

When information sharing is automated, junior bankers no longer have to stop what they are doing to notify their team of senior relationship managers on why a deal stage changed. Receiving these updates automatically allows the team to consistently be on the same page about deal stages, effectively reducing the amount of time spent on calls or spent producing ad-hoc email reports.

Work smarter to avoid burnout

The workaholic culture that contributes to junior banker burnout still has a long way to go in terms of improving work/life balance, but implementing a purpose-built solution such as DealCloud is a step in the right direction. When reporting and deal updates become automated, junior bankers are no longer expected to spend their time constantly pulling and analyzing information for their teams.

To learn more about how Intapp DealCloud automates processes and saves time for investment banking firms, schedule a demo.