The complexities of venture capital (VC) pipeline management are well known, with firms often juggling many deals at once. As limited partners’ expectations and competition increase, VC firms need to search for an industry-specific technology platform that goes beyond deal management to help dealmakers stay on top of deal flow and ahead of the market.

Investing in the right pipeline management solution can help VC firms better prioritize deal flow and avoid potential pitfalls. However, it can be challenging to determine exactly what to look for in deal flow software for venture capital. Here are six tips for VC firms when evaluating pipeline management solutions.

1. Seek a cloud-based platform

Firms with multiple key players involved with various deal stages need to keep their data and processes well-organized. Manual processes increase the risk of key data mismanagement, miscommunication, and lack of transparency. In contrast, a VC pipeline management solution that serves as a single source of truth can promote organization, encourage transparency, and mitigate confusion around deals.

Firms with hybrid or remote workforces can use pipeline management solutions to consolidate resources such as relationship management, third-party data providers, and data reporting to ensure every individual has what they need to contribute effectively and streamline the dealmaking process. Cloud-based connected firm management platforms like Intapp DealCloud can further ease communication and access, making essential information and reporting capabilities automated, secure, and accessible firmwide.

2. Find a customizable solution

When evaluating VC pipeline management solutions, it can be difficult to find a platform that matches your firm’s unique style and strategy. No two firms are alike, so no single solution will work for every firm. VC firms should look for software that lets them customize features and embrace their individual workflows and goals.

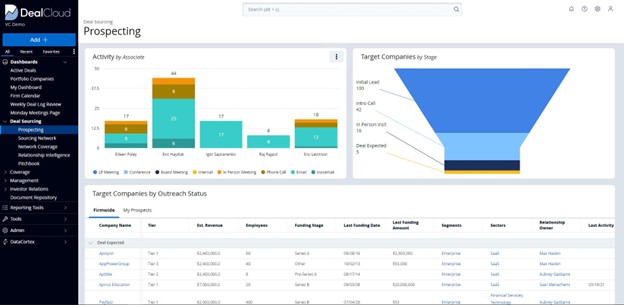

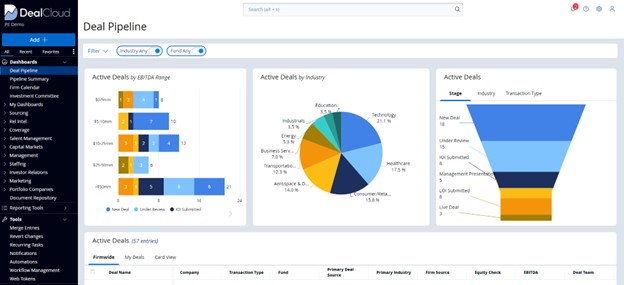

Adopting a customizable VC pipeline management solution helps firms better implement new systems with little interruption to existing workflows. Truly autonomous options take customization to the next level, letting users build unique dashboards and create automated reports to update their firms at a preferred cadence.

3. Streamline mobile access

Our 2022 Dealmaker Pulse Survey reported 73% of dealmakers anticipate more travel in the upcoming 6 months as business returns to normal post-pandemic levels. To ensure every member of your firm has deal information readily available to them at all times — especially while on the road — you must implement a pipeline management solution that offers a mobile component.

To help VC firms succeed in competitive and fast-paced environments, DealCloud’s user-friendly mobile component increases accessibility and firmwide adoption by allowing individuals to contribute to deal flow no matter where they are.

4. Integrate with current software

It’s common for VC firms to use multiple platforms to reach their various goals, but efficiently managing several software solutions with different logins can be overwhelming. Instead, VC firms should look for a pipeline management solution that integrates with the software they already use and stores all data in a single location.

DataCortex integrates with tools like Pitchbook, Preqin, SourceScrub, and other third-party data providers to create a single source of truth. DataCortex also provides valuable insights to the existing data within the DealCloud platform.

5. Encourage collaboration and transparency

It’s imperative that VC firms adopt a pipeline management solution that encourages collaboration across teams, to not only increase transparency but also store and share data and documents with ease.

To improve overall communication, DealCloud offers collaboration features like firmwide calendars, document sharing, specific user permissions, and automated email updates that keep every individual up to speed.

6. Partner with an industry-specific provider

VC firms have specific needs that generalized pipeline management solutions don’t address or prioritize. Implementing these generic solutions can present problems such as weak executive network management and mismanaged deal sourcing. Industry-based pipeline management solutions, on the other hand, provide firms with the resources and tools necessary to accomplish VC-specific tasks with ease.

DealCloud provides an industry-specific VC pipeline management solution, purpose-built by experienced financial services professionals to increase efficiency within firms. The platform’s one-click tear sheets automatically generate reporting that would otherwise take hours to create manually. By leveraging industry-specific software with integrated functions like this, dealmakers are well-prepared to reach their goals.

Request a demo for a VC-minded pipeline solution

By deploying pipeline management solutions based on these six criteria, VC firms can position themselves ahead of the competition. VC firms need customizability, software integration, and mobile access, and enterprise-grade solutions like DealCloud guarantee high-quality deals and bolster firmwide success.

Request a demo to learn more about Intapp DealCloud’s VC pipeline management solution.