Finding the proper technology to manage deals at every stage of the pipeline has always been a challenge for venture capital (VC) firms. Never has this been more apparent than in 2020 — a volatile year for the capital markets at large. No one could have anticipated that this year would result in record levels of dry powder raised. According to Pitchbook, there was a 39% increase year-over-year in public listing sizes, despite a sizable decline at the beginning of the year.

The pandemic influenced more than just the amount of committed capital. It also influenced the type of industries VC firms chose to pursue. Throughout the year, firms shifted their focus to health and wellness, productivity and collaboration, and banking and finances.

With so much change, VC firms are quickly adjusting to new priorities, and have moved relationship management to the forefront of all firm activities. As we continue into 2021, there is promise for continual growth enabled by organizational and data prioritization.

In this article, we review the key technologies VC firms can use to navigate uncertainty and effectively manage deals at each pipeline phase.

Manage your portfolio with technology built for VC firms

Thanks to pipeline management technology like Intapp DealCloud, VC firms can better maintain and organize their pipelines. DealCloud lets you view your investment volume, not only by stage and round, but also by seed or series. This helps you understand the status of your initiatives and produce relevant updates in a timely manner.

With integrations like the Microsoft Outlook add-in, emails, calendar events, and file attachments from your inbox can update automatically within DealCloud. You won’t have to waste time on manual data entry, and you can easily find relevant data for new and active deals within your pipeline.

Organize your sourced deals and optimize for results

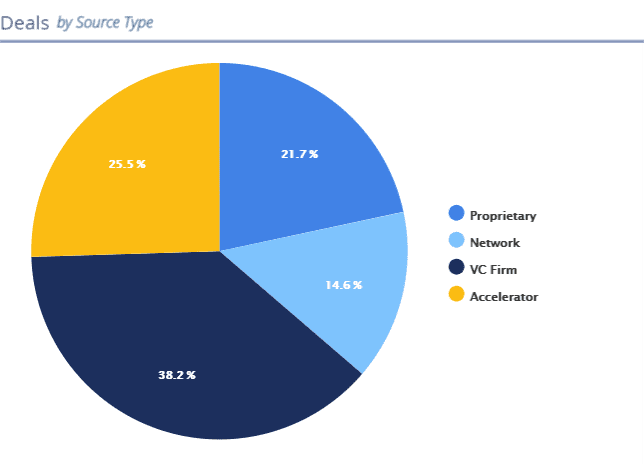

Properly managing prospective deals is hugely important for building and maintaining new relationships, as it allows you to position your firm at the top of a target company’s short list of investors. By organizing your deal-source pipeline within DealCloud, you can review progress, outreach, and funding at a glance.

Enhanced visibility of the firm’s deal sources means each conversation is properly tracked and revisited in a timely manner. It also encourages firmwide accountability and ownership.

Break down your firm’s deals by source type.

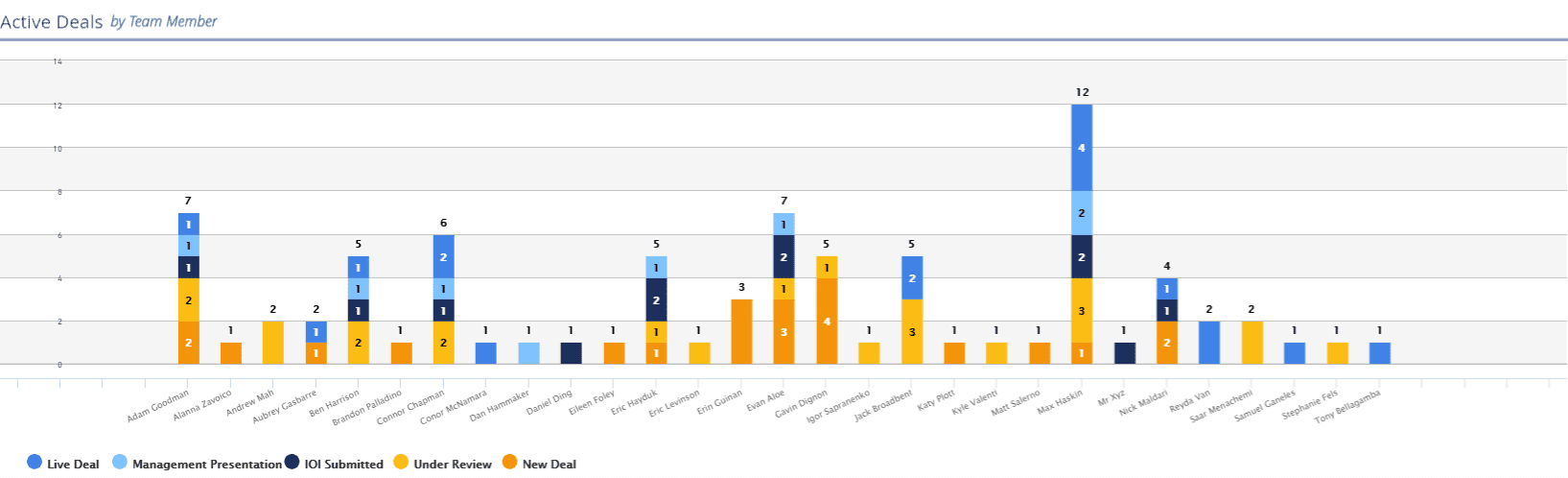

Focus the efforts of your team

Being able to view pipeline updates at the associate level means management better understands where teams are focusing their efforts, allowing for quick realignment and refocusing when needed.

Information is always accurate and readily available for DealCloud users, as the platform updates data in real time. Rather than waiting for associates to manually provide updates, management can view data in the platform when they need it. Management can also use this technology to assign new deals to team members, allowing the pipeline to reflect every step of progress from initial assignment to a closed deal.

You can organize your active deals by team member in DealCloud.

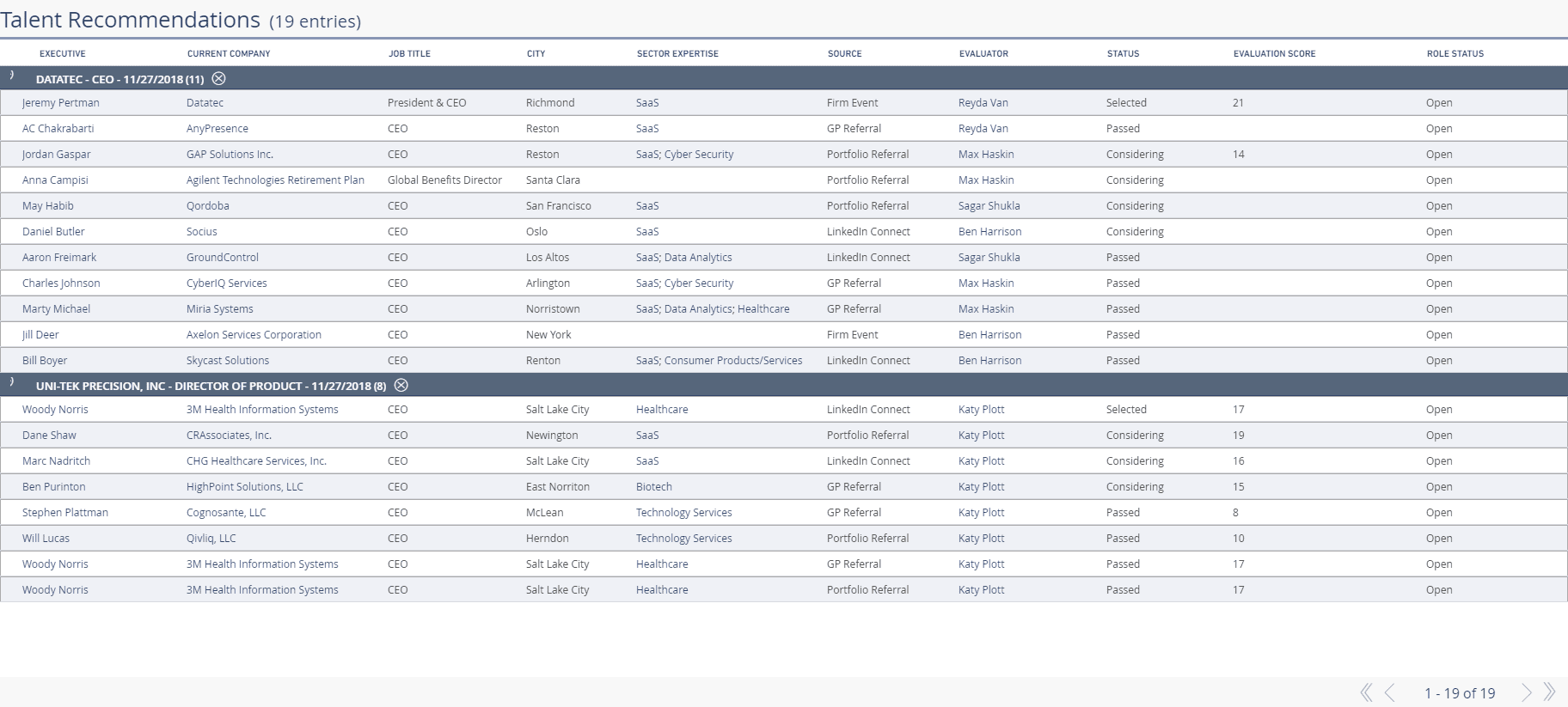

VC firms can also build talent pipelines that allow investors to organize and prioritize open roles within the firm or portfolio companies. To stay organized, most firms label prospective candidates by stage of consideration, current job title, location, source, and evaluation by firm associates. Thanks to smart, purpose-built technology, hiring for vital roles can be simple and clean.

Build a talent pipeline that’s clean and comprehensible.

Improving dealmaker performance

Venture capital firms must manage a wide variety of information that’s vital to the success of the organization. By properly housing this data within modern pipeline management solutions like the DealCloud platform, you can improve your firm’s dealmaker performance and enhance firmwide efficiency.

Schedule a demo to learn more about DealCloud’s pipeline management technology for VC firms.