DCM is growing rapidly. S&P Global Ratings Research predicts that $11 trillion in corporate debt will mature from 2022 to 2026.

Deal capital markets (DCM) are pulsating with fresh, exciting opportunities for investment firms. But seizing them demands agility. You need streamlined systems that let you execute deals at lightning speed, all while keeping a firm grip on risk.

Many DCM firms still use fragmented systems like spreadsheets and email to manage data. This old-fashioned method is not effective, making it hard for teams to find new information and effectively serve clients. Using these outdated systems often leads to data leakage that prevents firms from fully understanding client needs and market opportunities.

Having a central database is crucial for success in debt capital markets. It connects data within the organization, making it clear for clients and the transaction process. Companies can use data to find patterns, personalize services, and make smart decisions for business deals.

Vertical-specific CRMs with centralized databases help DCM professionals operate more efficiently. This system keeps all contacts, activities, and important information in one place, making data more accurate and consistent. It also helps teams work together better and communicate faster to close deals quickly.

Enhance transparency, collaboration, and teamwork

To speed up deals, DCM professionals must easily share relevant information and updates with each other. A central database within your firm’s deal and relationship management platform can greatly increase transparency across teams, to transform firm-wide knowledge into actionable intelligence.

This database stores information about deals, including debtors, deal structure, investors, and applicable regulations. Professionals can also save time by finding the data they need in one place, instead of asking colleagues or searching emails.

With Intapp DealCloud cross-collaboration feature, teams can collaborate and communicate in one place. Everyone with permission can access the most up-to-date content and data. Teams can also update and collaborate on content and receive immediate notifications and updates on ongoing deals in real time.

Improve market and industry insight

Intapp DealCloud’s database combines market data with your firm’s data. It connects with external solutions and data providers like S&P Global Market Intelligence, PitchBook, and Preqin.

Intapp DealCloud data connections simplify market research by letting users search, find, and filter info without visiting many websites. By bringing together your company’s data sources, businesses can access necessary analytics and important data.

These improved data analytics features allow professionals to make quicker, more knowledgeable decisions regarding potential transactions. Your company can use these resources and insights to achieve important goals and understand market trends better.

Intapp DealCloud also predicts purchase decisions, helping your team make wise choices about debt capital market investments.

Close deals faster

Your firm can also leverage Intapp DealCloud Relationship Intelligence to quickly create new deal flows. This database gives a score to a deal by comparing it to similar past market transactions. These characteristics include industry, sector, and revenue data and help make better predictions and informed decisions about potential deals.

To make sure the predictions match your firm’s goals, your team can change the weights given to different attributes. For example, you might score a potential deal higher if the investor has worked with your team before. Once you determine how you want to score deals, the system will streamline the scoring process so you can quickly make decisions.

When your company gets a new deal, your employees can use Intapp DealCloud integration with Microsoft Outlook. This integration allows users to easily add and update information about the deal. Users can securely sync information and data from their email inboxes directly into the platform. Your company can create records for new deals, contacts, and companies.

This integration allows users to securely sync information and data from their email inboxes directly into the Intapp DealCloud platform.

Additionally, Intapp DealCloud will automatically sync and attach files and metadata from email conversations to these records. This makes it easy to see all the relevant information in one place. These features save time and help your employees complete deals more quickly and accurately.

This integration allows users to securely sync information and data from their email inboxes into the platform. Your company can create records for new deals, contacts, and companies.

These intelligent systems also automatically sync and attach files and metadata from email conversations to records and make it easy to access all relevant information in one place.

Manage conflicts and ensure compliance

Laws in the U.S., such as the Dodd-Frank Act, have rules for investment banks in the debt capital markets. To do well in these markets, you need to handle conflicts of interest and private information properly.

Having a single source of truth lets your professionals easily search for shareholders, and other related parties to prevent conflicts.

With Intapp Conflicts, you can use a range of tools to research and handle conflicts of interest during a deal.

Intapp Employee Compliance software helps compliance officers. It provides a complete view of employees’ personal investments, trading, gifts, and outside activities. This view helps officers reduce risk and avoid fines and damage to their reputation. This helps them reduce risk and avoid fines and damage to their reputation.

Improve data precision, security, and management

DCM companies must follow data protection laws like GDPR and SEC rules as they deal with private information.

A central CRM database can help your firm better manage classified data and ensure compliance with regulatory requirements.

These capabilities negate the need for manual checks across multiple systems, saving your professionals time and effort.

Intapp DealCloud keeps data safe for DCM firms, meeting privacy and governance requirements. It helps handle information responsibly, making deals better and faster.

Simplify complex connections and interactions

Competition is fiercer than ever, which is why your firm must keep its strategies and relationships strong.

Your team members build connections with many professionals and companies throughout the entire transaction process. As these connections become more numerous and complicated, your teams require a dependable method to store information about them.

It takes too much time and makes finding and updating information harder. By centralizing communication data, this central database strengthens relationship management and lowers the risk of lapsed connections.

Firms can also easily transform day-to-day activities into actionable relationship intelligence by sourcing leveraged finance investments. Your company’s finance experts can use Intapp DealCloud’s Lender Network dashboard to see co-investors and other deal participants.

Intelligent filters assist creditors in quickly locating desired information. These filters allow creditors to view companies based on their strategies, institution type, and deal stage.

Manage relationships more efficiently and effectively for the long-term success of the firm. Use Intapp DealCloud to source and track data in a single, accessible place.

Enhance portfolio management and deal tracking

Companies that specialize in deal management need to closely monitor the progress of each transaction they pursue. This is particularly important in the constantly evolving investment landscape. Intapp DealCloud helps professionals manage deals. It has benefits for firms wanting to improve deal, relationship, and pipeline management.

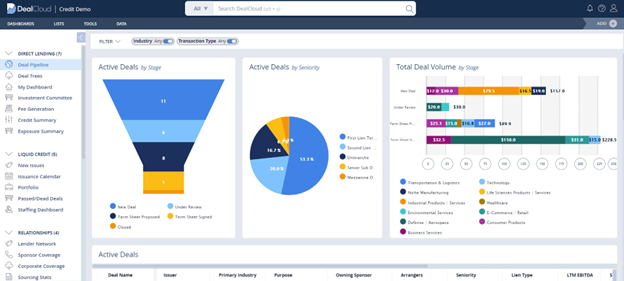

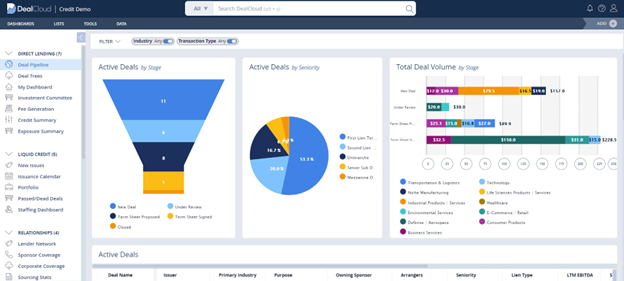

Through a centralized database firms can automatically track all deals from origination to close. It provides real-time visibility into the status of each deal and reduces the risk of lost or forgotten deals. Debt market professionals have access to a dashboard.

The dashboard displays information about the deals in their pipeline. This includes details such as the stage, importance, and size of each deal.

Intapp DealCloud automates portfolio management for DCM firms. It analyzes metrics like portfolio size, yield, and risk. This helps firms make better investment decisions and monitor portfolios effectively.

Use Intapp DealCloud to streamline debt market transactions by collecting and analyzing data for valuable insights. These valuable insights enable your organization and staff to uncover additional business prospects.