How The Riverside Company simplifies operations with Intapp DealCloud

The Riverside Company (Riverside) is a global investment firm founded in 1988 that has invested in more than 600 small and midsized companies with an eye toward fueling transformative growth and creating sustainable value. Contending with disparate applications and workflows, along with compliance requirements and enterprise reporting on top of an industry-specific CRM platform, Riverside adopted Intapp DealCloud for its own dealmaking processes.

The Riverside Company (Riverside) is a global investment firm founded in 1988 that has invested in small and midsized companies with an eye toward fueling transformative growth and creating sustainable value.

Streamlining operations to improve business outcomes

During the past decade, private equity firms across the board have invested significantly in deal teams to ensure that, as a transaction moves from stage to stage, no time is wasted, and no information or opportunity is lost. Although the process is painstakingly thorough by design, inefficiencies run rampant. Without clear communication regarding which individuals are responsible for specific tasks and inputs, staff members tend to err on the side of flooding the CRM platform with superfluous information or simply not using the system at all, leading to widespread frustration regarding time wasted on previously completed tasks.

Private equity firms understand that operational efficiency is a critical competency for their portfolio companies. Operational efficiency drives down costs, centralizes knowledge, facilitates communication, and mitigates talent attrition. To achieve these benefits, selecting and implementing the right technology is the single most important success factor. In this brief, we will cover how private equity firms can build operational efficiency internally to achieve the same benefits they witness in their portfolio companies. Further, we will drill down on how firms can use technology to improve business productivity, close the compliance gap, foster collaboration, and streamline processes and workflows.

In Riverside’s case, it was the opportunity cost of unaddressed inefficiencies that tipped the firm toward researching, selecting, and implementing a solution. In fact, the initiative was such a high priority that the firm to dedicate full-time staff members to the project, and with the CIO’s goals in mind, set out to create greater synergy between technology and origination.

We have connected Intapp DealCloud to our HR platform so that every night we’re receiving all of our employee and contingent HR records.

RUSSELL LEUPOLD, MANAGING DIRECTOR, BUSINESS TECHNOLOGY OFFICE, THE RIVERSIDE COMPANY

Improving business productivity

One of the items Riverside reviewed in its modernization process was one of its most pervasive pain points — deal-screening memos. Prior to implementing Intapp DealCloud, the deal coordinator and associate-level employees were struggling to systemize the production of weekly deal-screening memos. “We relied heavily on our deal screening memos that we published for our weekly deal screening meetings,” said Russell Leupold, Managing Director, Business Technology Office for The Riverside Company. “In our previous system, our coordinators would enter basic information into the CRM, and right on top of that, our associates were tasked with drafting memos for many of those same deals. We soon realized that there was significant overlap in the data fields, which created duplicative work.”

When the firm switched to Intapp DealCloud, it mitigated this problem by segregating the demographic data fields and assigning them to coordinators. When the coordinators enter demographic information into the system, Intapp DealCloud’s technology leverages a template report to generate the screening memo automatically. “Essentially, the coordinators have the front-end demographic data and the associates own the narrative on the back end, resulting in a consistent, polished work product for our deal teams,” said Leupold.

Like the deal-screening memos, tear sheets and monthly deal-metrics reports stood out as cumbersome and time consuming or manually produced. Tear sheets — profiles of executives, companies, or banks — were not previously available. Monthly deal-metrics reports — which include a summary of the number of deals in the pipeline by source, size, and auction type, as well as deals in each pipeline stage along with capital deployed — used to take several hours per month, per fund.

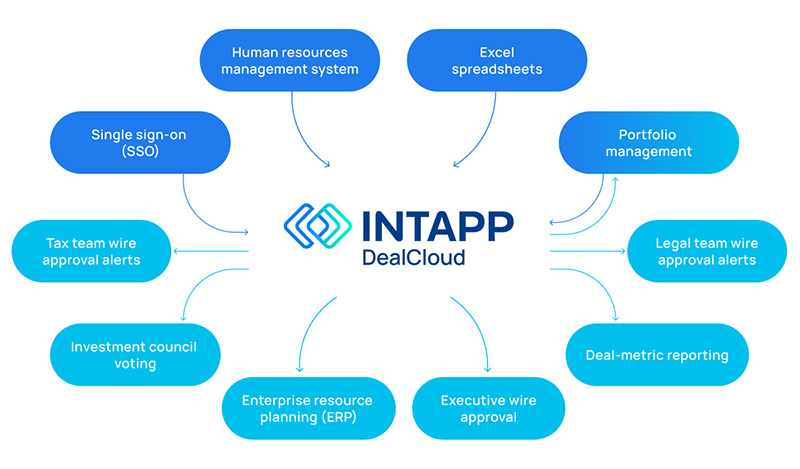

Once the entire organization adopted Intapp DealCloud’s technology, all of the firm’s intellectual capital could be centralized in a single repository. The system integrated various platforms through a series of application programming interfaces (APIs), so complete reports could be generated with the push of a button. Deal-metrics reports could now be completed in minutes rather than hours. Prior to Intapp DealCloud deployment, Riverside struggled to integrate its business development and marketing functions because the email marketing platform was separate from the CRM. “We didn’t have a closed loop between the way our deal-sourcing contacts were engaging with our email distribution,” said Leupold. “The relationship managers couldn’t see open or clickthrough rates, or even more importantly, optouts and bounces.”

With Intapp DealCloud Dispatch, Riverside gained immediate visibility into key contacts. When a key contact changes jobs, it’s reported within the same platform where deals originate. “Because all of the data is centralized, relationship managers and deal teams can now incorporate marketing data into tear sheets, which indicate how familiar that individual is with our newsworthy updates,” Leupold said. “This level of insight potentially leads to a greater number of deals sourced and certainly provides a fuller picture of the strength of the relationship. And it can all be calculated quickly.”

Closing the compliance gap

Given the relationship-driven nature of the private equity industry, key-person risk — the degree to which an individual’s presence, absence, or behavior disproportionately affects a firm’s value — becomes more pronounced and salient. With a keen focus on mitigating key-person risk within its firm of more than 300 professionals, Riverside has used Intapp DealCloud’s technology to systemize proactive measures that reduce risk as people move into and out of the organization.

“We have connected Intapp DealCloud to our HR platform so that every night we’re receiving all of our employee and contingent HR records,” said Leupold. “We’re keeping those records up to date as people are hired and transitioned out of the organization. This means that we can tag those individuals to deals or interactions when they’re onboarded and automatically deactivate them when they’ve left.”

Riverside manages compliance with single sign-on (SSO), through which its professionals access all of the firm’s platforms and tools — including Intapp DealCloud.

When a team member leaves, administrators deactivate that person’s SSO authentication, revoking their access to Intapp DealCloud and all other systems. “Now we don’t even consider rolling out a platform that doesn’t support single sign-on because it serves as the front door to every system we deploy at the firm,” said Leupold. “It’s also one less piece of maintenance to worry about on a daily basis, and it has a positive effect on new employees coming in on Day One, because they are granted access to everything they need.”

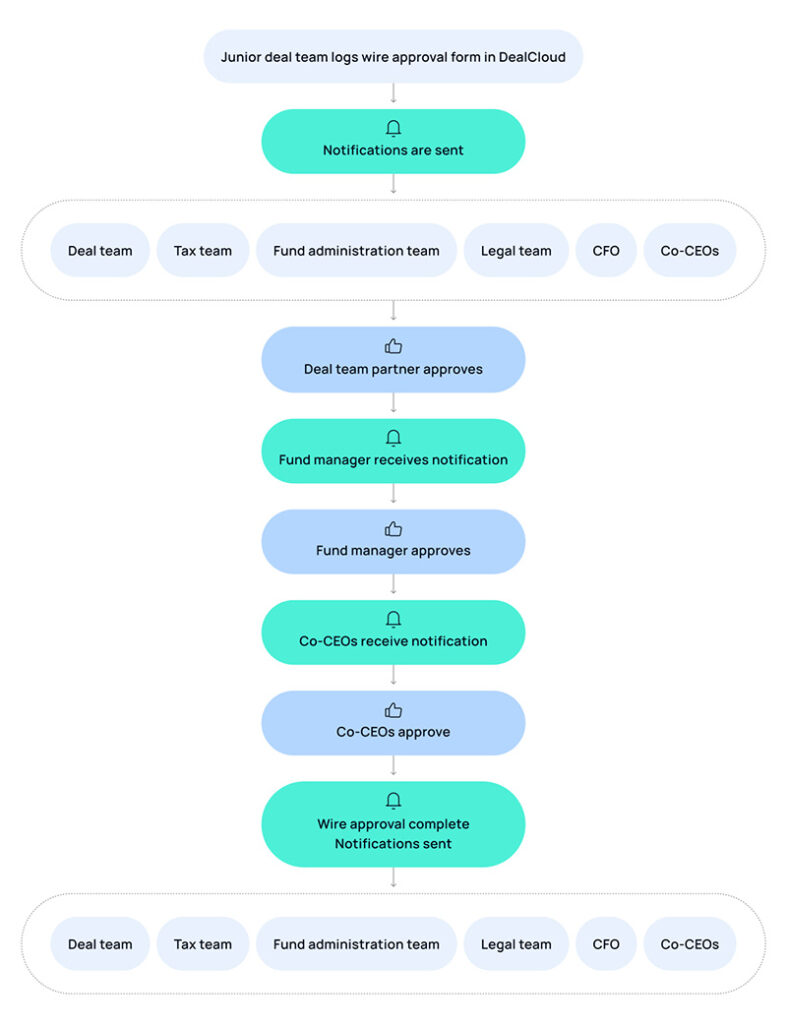

To maintain compliance, Riverside needed a fully auditable system of record to house a complete history of wire transfers related to transactions; Intapp DealCloud technology delivers on this requirement. “Essentially, a deal-team member will start by creating a new wire approval — including a description of equity versus coinvestment, as well as the amount to be transferred — and that item gets attached to the deal in Intapp DealCloud,” said Leupold.

From there, Intapp DealCloud fires notifications to the finance team, the CFO, and the deal team, so that everyone can be aware that the process is started. It also automatically sends a notification to the partner in charge of that particular deal, who then clicks a link to submit approval through Intapp DealCloud. With approval in place, Intapp DealCloud notifies the fund manager, and the CEO receives a request to submit approval. The system submits a final completion notice to the fund administration team as a confirmation, and also to third-party legal and tax teams.

By design, there’s no integration between the wire approval process and Riverside’s bank; the processes in place adhere to all compliance requirements without adding administrative burden to the firm. Previously, the process relied on clumsy email communication that was not centralized — the migration to Intapp DealCloud represented a marked improvement not only for compliance, but also operational efficiency. The previous procedure was unsustainable for a variety of reasons: “It was time consuming, and it left too much room for error when millions of dollars could be sent to the wrong place,” Leupold said. “We could not allow ourselves to be vulnerable to that cybersecurity risk.”

Riverside wire approval workflow

Enhancing business agility and corporate culture

Historically hyper-focused on profits and shareholder value, private equity firms are expanding their perspective to target business agility. As the measure of how quickly people are able to respond to a business need or opportunity, business agility hinges on having the right tools and processes in place to access and share information. The benefits that business agility brings to the organization extend beyond operational excellence; agility also has a positive impact on collaboration and corporate culture.

Riverside had struggled with dealmakers who felt disconnected from one another and closed off from access to institutional knowledge. “The message was consistent across all of our offices — stakeholders wanted a platform that facilitated information sharing,”

Leupold said. “For example, our London office was working on a deal that was essentially a carbon copy of a U.S. opportunity we evaluated 3 months prior. With Intapp DealCloud technology in place, the deal teams could collaborate efficiently across offices to gather valuable learnings, both directly from the tool and also over the phone or email.”

Enabling staff to easily access information, efficiently collaborate, and confidently make decisions positively affected Riverside’s corporate culture. “Firmwide access to a reliable communications log has measurably improved collaboration, accountability, and transparency,” said Leupold.

Reimagining processes and workflows

Although many firms rightfully focus on technology transformations that address urgent issues, it’s also important to incorporate quick-win improvements. For example, Riverside manually collected votes from the Riverside Investment Council (RIC), which is comprised of its fund managers, the CEO, and several additional senior executives. Members of the council are responsible for evaluating and scoring deals once the deal reaches the letter of intent (LOI) stage. Prior to the implementation of DealCloud’s technology, Riverside performed this action in a separate application that did not centralize data or facilitate firmwide reporting.

With DealCloud’s technology in place, the team creates a memo when a deal reaches the LOI stage. The posting of this memo to DealCloud triggers an automated notification to the committee and the creation of a poll. From there, all RIC members review the details of the deal and log their votes — strongly support, neutral, or do not support — along with optional commentary to explain their selection. DealCloud then generates an average score and prepares a summary of voting activity, which is distributed to RIC members. To create a complete record, Riverside incorporated the history of all previous RIC vote submissions into the tool, centralizing historical data and providing quick access to the entire body of institutional knowledge.

The benefits of the re-imagined RIC vote collection process extend beyond council members, offering visibility to staff who have a personal interest in certain deals. As surveys and polls are deployed, DealCloud displays the real-time votes and commentary on a dashboard where all members can see the results. “This functionality is valuable because it allows people to vote ahead of time, which is particularly important for those who are traveling,” Leupold said.

Democratizing and streamlining the RIC’s voting process significantly improved Riverside’s business agility. “Rather than getting bogged down in the process of collecting opinions and conducting lengthy discussions on specific deals, each team member makes their comments, casts their vote, and has their voice heard,” Leupold said. “The team has confidence in the objectivity of the decision-making process, and time previously spent on debate and discussion can be applied to other business activities.”

Executive Summary

By streamlining mission-critical processes and workflows, Riverside tackled its most cumbersome operational bottlenecks, eliminating staff pain points, facilitating cross-functional collaboration, and strengthening corporate culture.

Employees express pride around working for a bestin-class organization with a strong growth trajectory, and leadership has confidence in decision-making protocols and the consolidation of institutional knowledge. “Intapp DealCloud has transformed our organization far beyond operational improvement,” said Leupold. “The tool offers us the continued potential to replace frustration with collaboration, and this continues to strengthen our corporate culture. Our senior management has confidence in the validity of our streamlined decision-making process, which frees up time to grow our business.”