Expand your network, close more deals, and generate higher returns with Intapp DealCloud. By centralizing all firm information regarding deals, relationships, and capital deployment, your firm can operate more efficiently and strategically.

Fund of funds software

With Intapp DealCloud, we were able to streamline our various systems into one consolidated platform that everyone could use at the same time. Now that we’re fully functional on the platform, it’s impossible to imagine going back to Outlook and Excel.

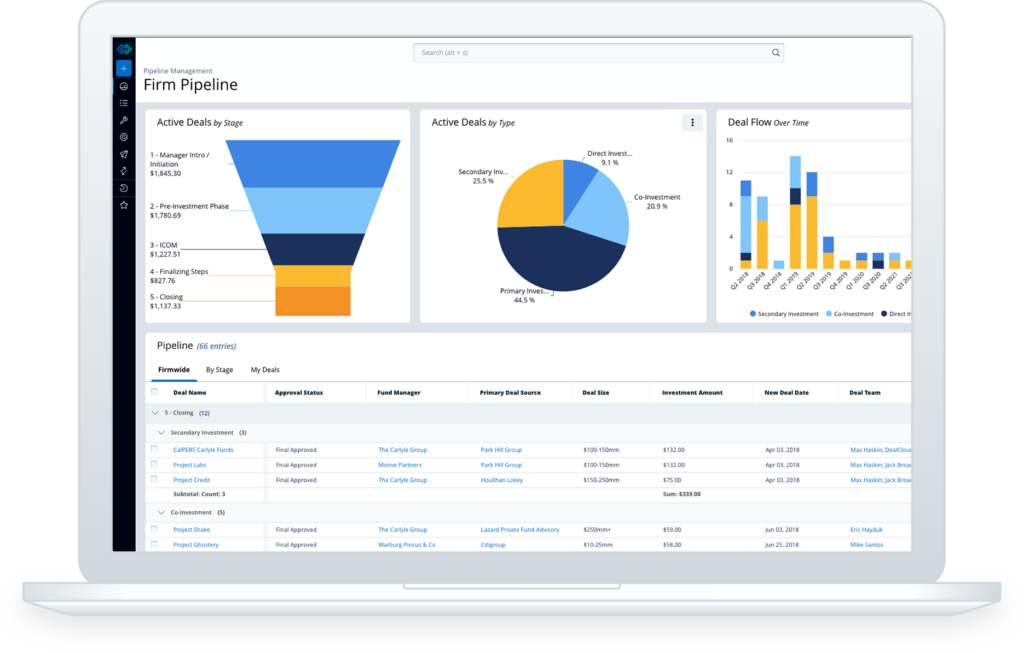

Today’s fund of funds require access to complex reports and custom dashboards on demand. Generic CRM platforms simply can’t address the need for real-time data for every stage of the investment lifecycle because they were built for a different business model — one that doesn’t consider a fund of fund firm’s complex relationship, deal, and funding structures. When fund of funds investors use software like Intapp DealCloud, they’re able to organize, tag, and report on that data to inform their daily activities, including tracking progress on negotiations, due diligence processes, or voting developments.

Whether your firm has just closed its first fund or completed hundreds of transactions, our vertical-specific software will help your firm grow and operate more efficiently. With a rich set of tools and features accompanying our core CRM platform, investors can quickly complete administrative, time-consuming tasks — so your professionals can spend more time building and nurturing relationships that lead to closed deals.

Fund of funds investors use Intapp DealCloud for fund monitoring; relationship tracking; fund manager coverage; deal and legal document management; business development activity tracking; industry analysis; and investment process creation and management.

Whether your firm focuses on a specific geography, deal size, or industry, Intapp DealCloud can help your investors transform a handshake into a closed deal using our fund of funds software.

Our platform was built by industry experts who know that not all fund of funds operate the same way. The pipeline, relationship management, and reporting needs of one user, team, division, or company may differ greatly from the next. That’s why our users have the granular control to tailor Intapp DealCloud on a user-by-user basis — ensuring that every individual has the necessary tools and views.

When it comes to reporting and analytics, team members can customize every dashboard, chart, graph, tear sheet, data sheet, and profile to meet their preferences and interests.

Fill out the form and someone will be in touch to provide a demo.