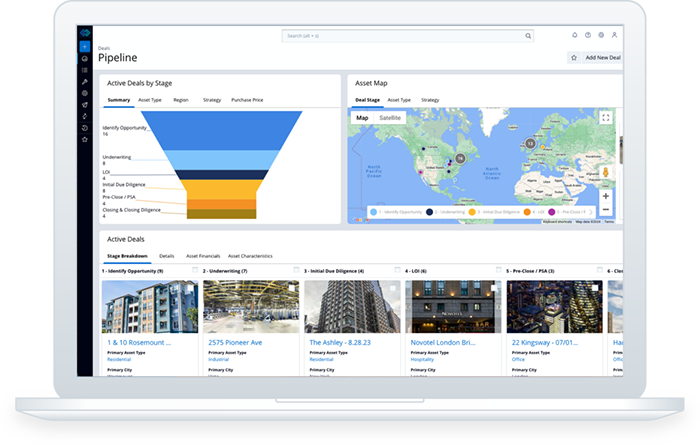

More informed decision-making leads to better investing outcomes. With full visibility into your opportunities, data, and relationships, your credit investing team can better collaborate on sourcing and capital allocation workflows. Discover new avenues of growth and close more deals — all with Intapp DealCloud. Our platform is built for how real estate credit investors and lenders work.