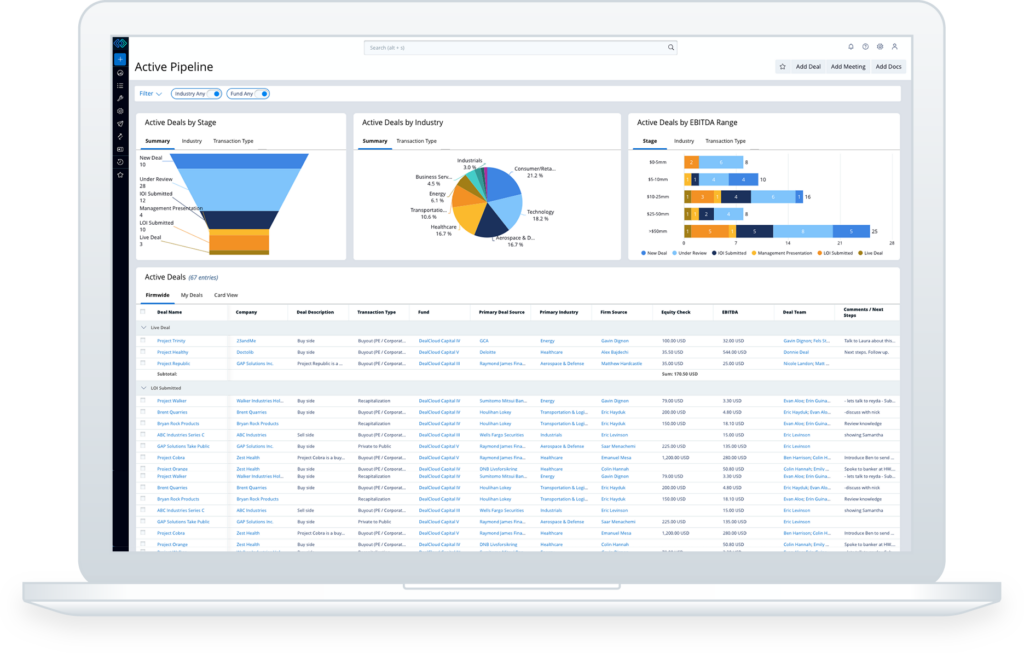

Give your professionals the tools they need to expand their networks, close more deals, and generate high returns. By providing a single source of truth for all information regarding deals, relationships, and capital deployment, Intapp DealCloud helps your firm operate more efficiently and strategically.