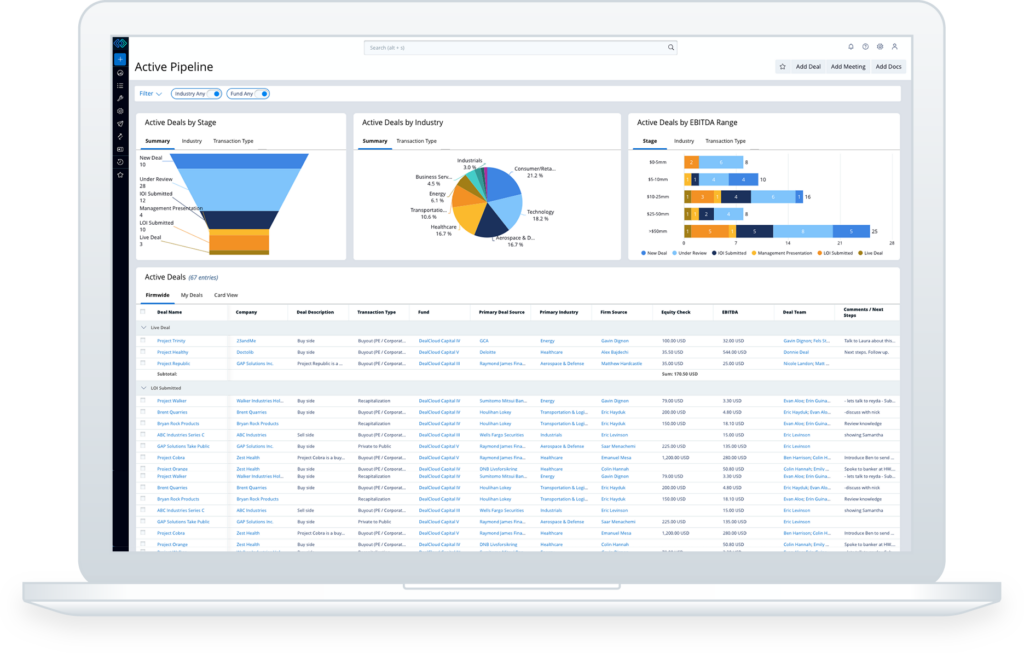

Expand your network, close more deals, and generate higher returns. By creating a single source of truth for all information regarding deals, relationships, and capital deployment, Intapp DealCloud helps your credit investment firm operate more efficiently and strategically.