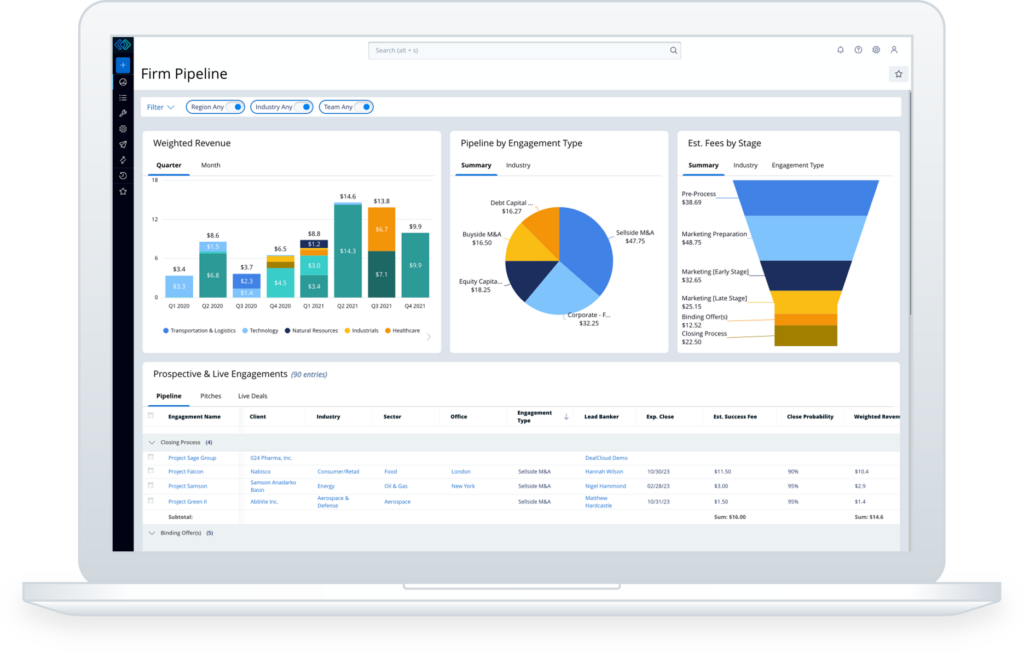

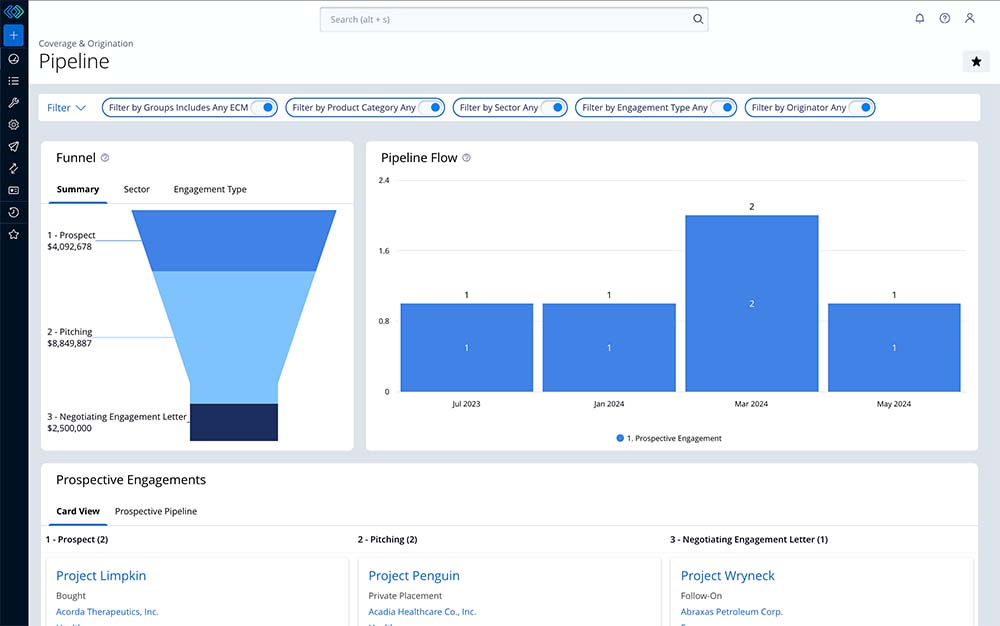

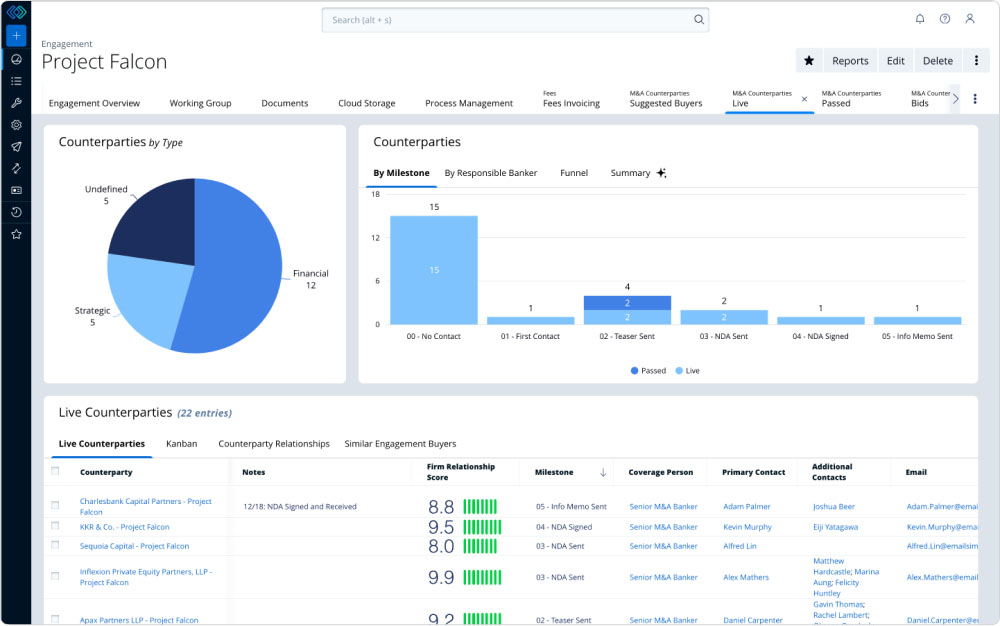

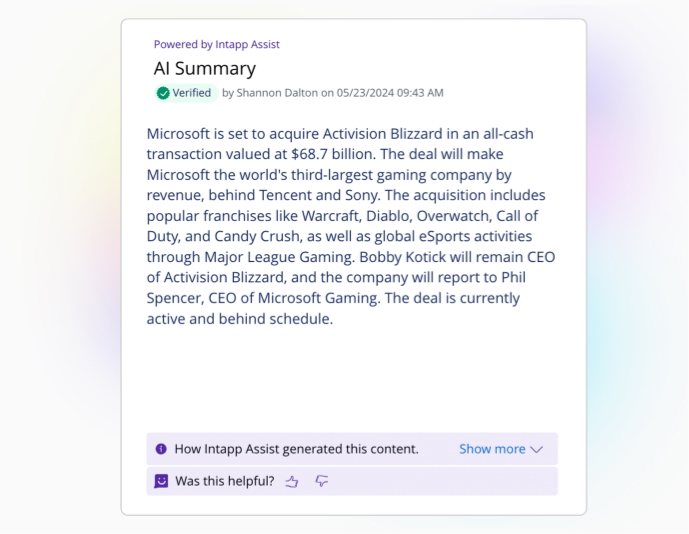

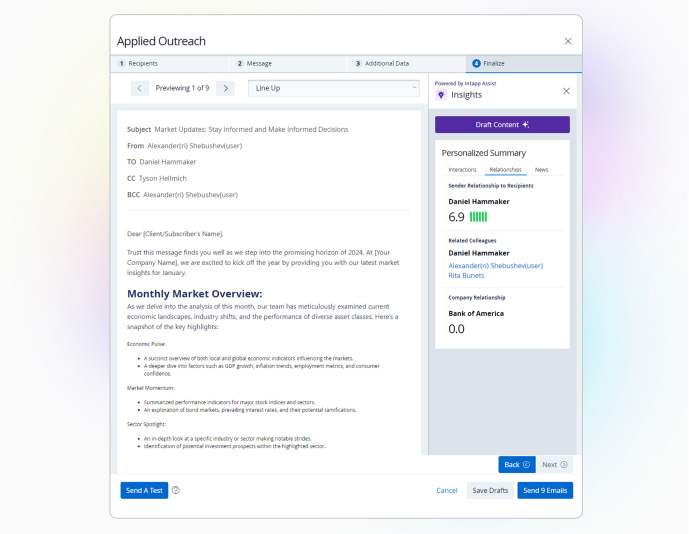

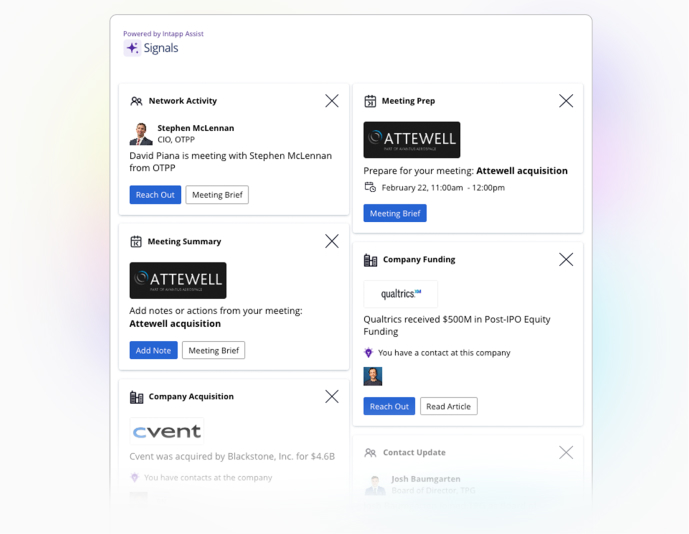

Boost win rates and productivity with an all-in-one deal, pipeline, and relationship management solution designed for investment banking and advisory firms. Get the connected firm and market intelligence you need to build stronger connections and accelerate deal execution — all with Intapp DealCloud.